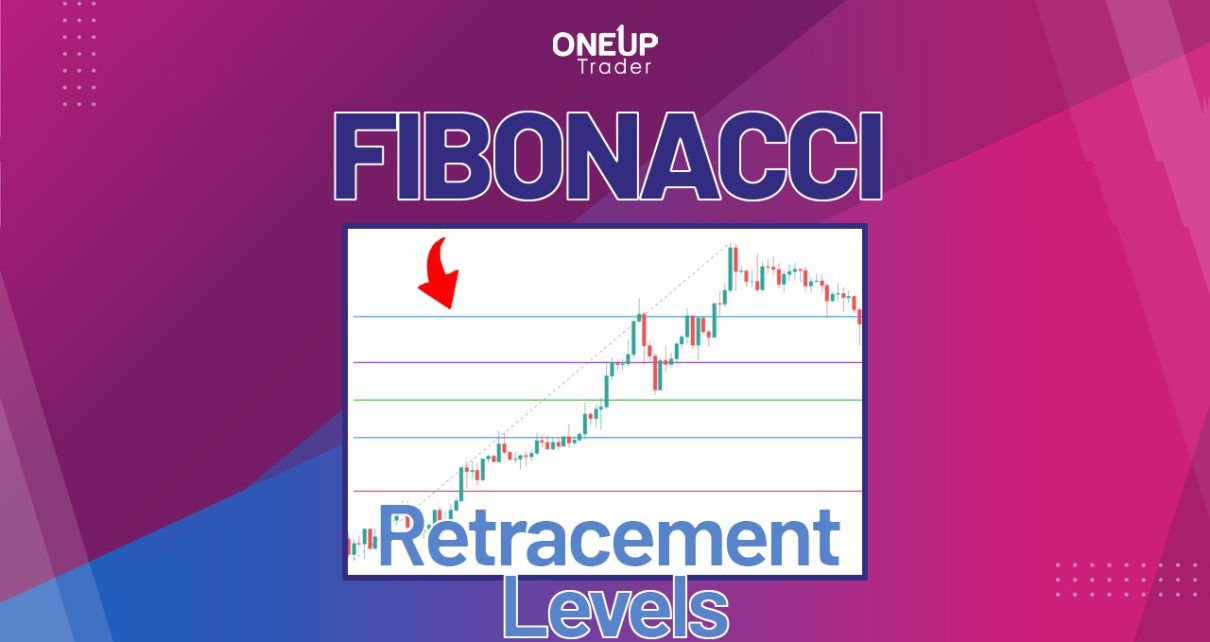

Trading the support and resistance levels of an asset is probably one of the oldest and most reliable technical strategies. It goes without saying that asset prices never trend in a straight line – any trending market is often punctuated with momentary pullbacks or retracements. This is where Fibonacci retracement levels come in. These levels Read More…

Strategies

False Breakout Candle Pattern

Breakout trading is the cornerstone of most technical indicators. It’s usually the simplest way to gauge the magnitude of a trend. And regardless of your trading strategy, you’re bound to experience some false breakouts, which will kill your strategy. So, how do you avoid false breakouts? And more importantly, how do you take advantage of Read More…

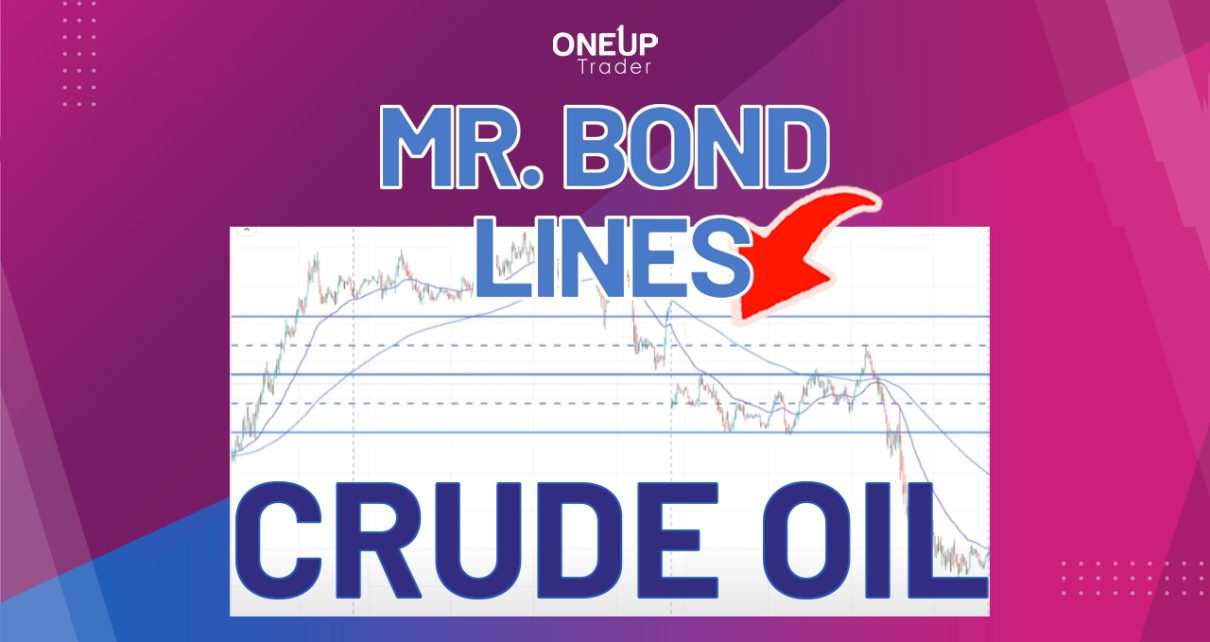

Simple Trading Strategy Mr. Bond Lines [VIDEO]

Have you heard about the Bond line trading strategy? It is a simple trading strategy that measures the daily ranges. Fun fact: It was developed in 2021 by one of the traders, named Bond. For those who were thinking the strategy was related to James Bond. Unfortunately, it’s not. It’s about finding the highest and Read More…

How to Read MACD Indicator – Explained

Moving average convergence divergence (MACD) is one of the most versatile technical indicators – it’s both a trend and momentum indicator. The MACD indicator can best be described as a 2-in-1 indicator; it shows the start of a bullish or bearish trend using the MACD crossover and the strength or weakness of a trend with Read More…

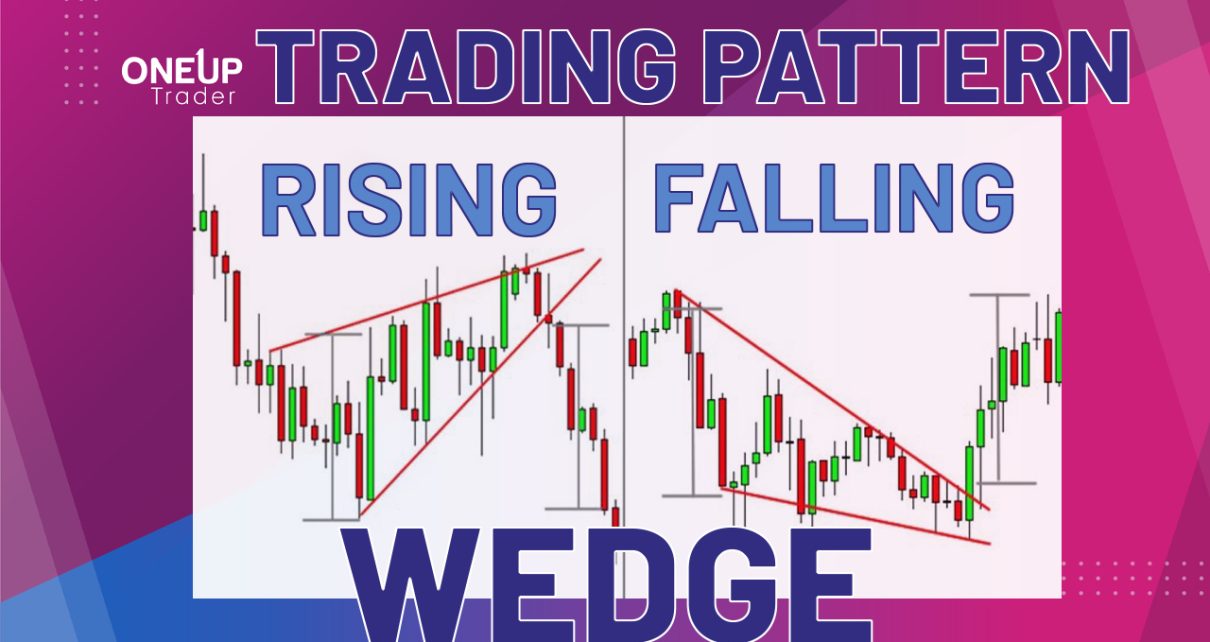

Rising and Falling Wedge Chart Pattern Trading

Any price action has a series of steady bullish and bearish trends punctuated by momentary price consolidation. When timed accurately, breakout trading strategies can be invaluable for catching trends while they’re just beginning. And this is what the rising and falling wedge chart pattern trading is geared towards. What are Wedge Chart Patterns? A wedge Read More…

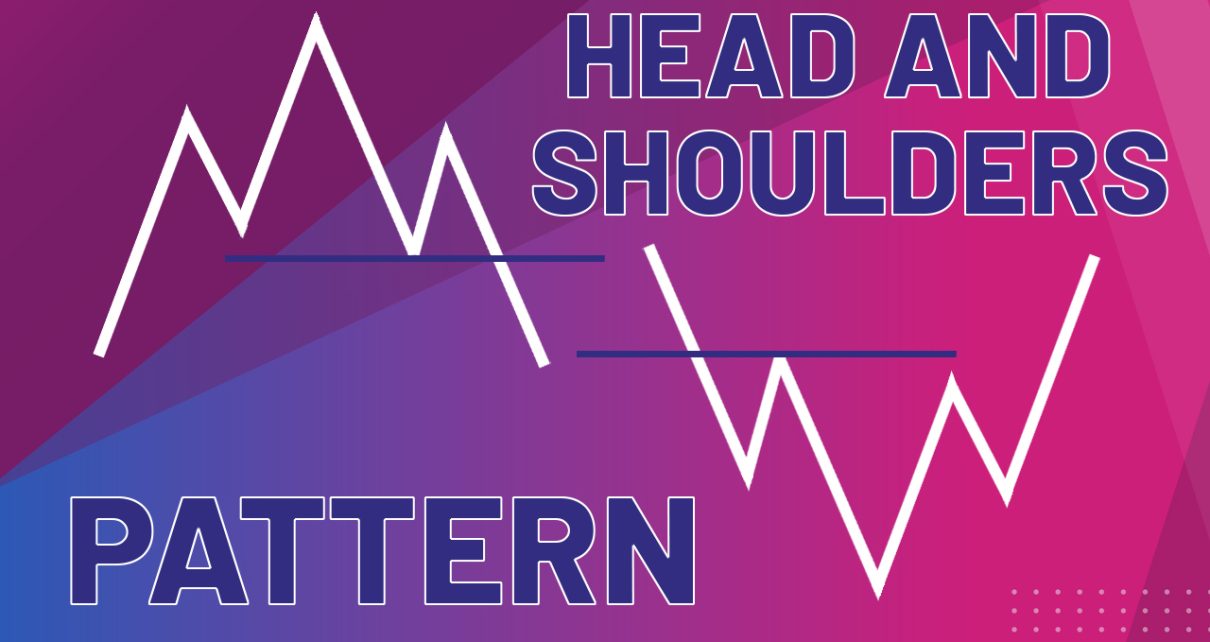

Head and Shoulders Chart Pattern Trading

Technical indicators have always been faulted for lagging, making price action analysis invaluable to any trader. With hundreds of chart patterns to choose from, it may not be easy to decide which one is more reliable and suited to your trading style. However, it’s a general consensus that the ideal ones should generally be easy Read More…