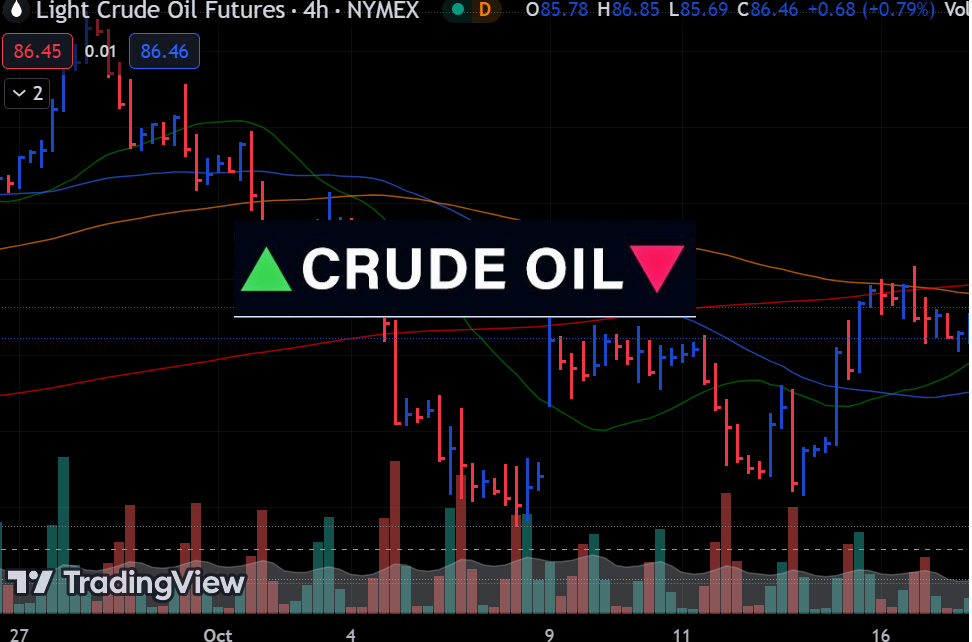

Introduction Crude Oil Futures (CL) are approaching a major support zone after a failed breakout attempt at the downward trendline and 100-week SMA in the previous analysis. The market remains under selling pressure. As of today, CL is trading at 67.67, down -3.00%, and nearing the key support zone between 66.00 and 68.00. A break Read More…

Uncategorized

Euro holding above support—breakout or another rejection?

Introduction The Euro FX futures (6E) continue to trade above support, holding gains after forming a bullish divergence at the lows. Price remains in a short-term recovery phase, but the 1.0580 – 1.0630 resistance zone and the 100-day VWMA (1.0581) are capping upside momentum. As of today, 6E is trading at 1.04585, up +0.19%, with Read More…

U.S. Dollar Index Eyes Resistance as Rally Stretches into Overbought Territory

Introduction As the U.S. Dollar Index (DXY) rallies toward key resistance levels, traders and analysts are closely monitoring whether this move will mark a sustained bullish breakout or a temporary reprieve in the broader downtrend that has characterized much of 2024. The index, which measures the greenback against a basket of major currencies, has experienced Read More…

Currency Futures Rally as Improved Risk Sentiment Softens Dollar

Currency futures rose on Friday as the dollar eased due to increased risk appetite. Risk sentiment improved after China announced stimulus measures to support the country’s stock market and risk-sensitive currencies like the Australian dollar firmed. However, the trend shifted on Monday as the dollar recovered on bets of a Trump win. On Friday, China Read More…

Trading Days Reduced To 10 Days At OneUp Trader!

Introduction Hey traders, We’ve got some exciting news to share with you today! We’re always looking for ways to improve our funded trader program and make your experience a high-quality one, and we think this latest update will do just that. We have reduced the required trading days from 15 to only 10 to get Read More…

JPY trade update: double top plays out as predicted, bearish momentum continues

Introduction Since the prior analysis conducted in mid-September, the bearish double-top formation has played out as predicted. Price Movement Since September 11 RSI (Relative Strength Index) Short-Term Outlook: Medium-Term Outlook: Final Call: