Introduction The U.S. Dollar Index (DXY) continues its impressive rally as we conclude the year, fueled by pro-growth and pro-dollar policies under the Trump administration. The index is trading at 108.068, breaking out of a long-term consolidation pattern and aiming toward its all-time high (ATH) at 114.789. The bullish momentum has intensified, with resistance levels Read More…

Month: December 2024

Currency Futures Tumble as Dollar Regains Strength

Currency futures collapsed on Monday as the dollar regained momentum after a brief pause on Friday. The dollar’s rally last week came after a hawkish FOMC policy meeting. However, it paused on Friday as US inflation figures came in softer than expected, allowing currency futures to rebound. The Greenback had a bullish week amid upbeat Read More…

Cesar returns with another 25K withdrawal: A dive into the mind of a master trader

Introduction After sharing Cesar V.’s remarkable achievement of withdrawing $76,500 in 40 days, we had the opportunity to sit down with him again to understand how his trading has evolved. What we discovered was not just a story of successful trading but a profound insight into how he understands and approaches the markets through the Read More…

Interest Futures Hold Steady Ahead of Key Inflation Data

Interest futures paused their decline on Friday as market participants awaited crucial US inflation figures for more clues on Fed policy. However, prices wallowed near weekly lows after a week of upbeat US economic data and a sharp drop in Fed rate cut expectations. The US will release its core PCE price index report on Read More…

Bitcoin CME Futures: Post-Target Update – December 20, 2024

Introduction Following our previous analysis from November 2024, Bitcoin hit our anticipated $110,000 target, delivering a massive 30% rally. However, since then, the market is showing signs of exhaustion, with price pulling back to around $93,690 (-15%). Technical Analysis Bearish Divergence on RSI Short-term Retracement Underway Moving Averages as Support Bullish Case: Higher Highs in Read More…

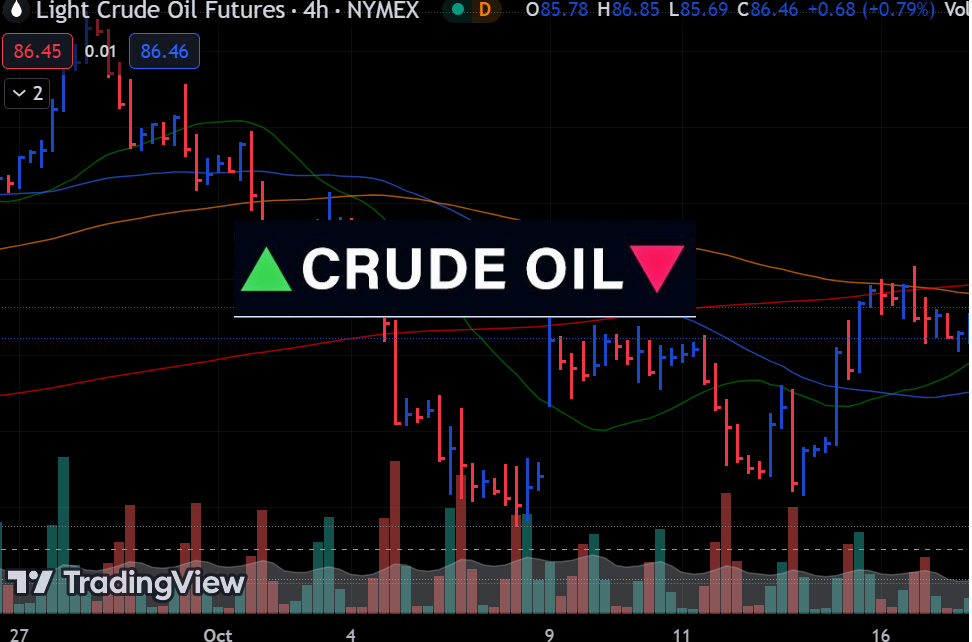

Oil Prices Weighed by Fed’s Cautious 2025 Projections

Oil prices remained fragile on Thursday after collapsing due to a less dovish outlook for Fed monetary policy in 2025. Meanwhile, a drop in crude inventories and a surge in crude exports helped support prices. On Wednesday, the US Federal Reserve lowered borrowing costs by 25-bps. However, instead of signaling more rate cuts, the central Read More…

Gold Declines in Anticipation of FOMC Policy Projections

Gold prices eased ahead of the FOMC meeting, where policymakers might forecast a more gradual easing cycle in 2025. At the same time, downward pressure came from a rally in the dollar and Treasury yields after upbeat US retail sales data. The US Federal Reserve will meet later and likely cut rates by 25-bps. Markets Read More…

Euro FX Futures (6E) Technical Analysis – December 18, 2024

Chart OverviewEuro FX Futures (6E) remain under pressure as the Dollar continues to rise. The Euro has been held at the support zone at 1.063 after the Trump victory rally of DXY. Weak momentum, confirmed by a declining RSI, raises the likelihood of further downside if bulls cannot push prices back into the prior range. Read More…

Equities Climb as Markets Eye Upcoming FOMC Meeting

Equities rose on Monday, with the Nasdaq hitting record highs as market participants looked forward to the upcoming FOMC policy meeting. At the same time, investors absorbed mixed PMI data from the US that showed pockets of weakness and strength in the economy. The Federal Reserve will hold its policy meeting on Wednesday, and markets Read More…

Currency Futures Slip on Adjusted 2025 Fed Rate Cut Expectations

Currency futures eased as the dollar extended gains after a strong week due to a drop in 2025 Fed rate cut expectations. Meanwhile, markets nearly fully priced a rate cut during the Fed policy meeting this week as inflation figures accelerated in line with expectations. December Fed rate cut bets (Source: Bloomberg) The greenback had Read More…