- There is a spinning top candlestick formation on the daily chart which is pointing toward bullish momentum in the near term.

- Looking at how we can take advantage of the spinning top for a great trade set up.

Technical analysis

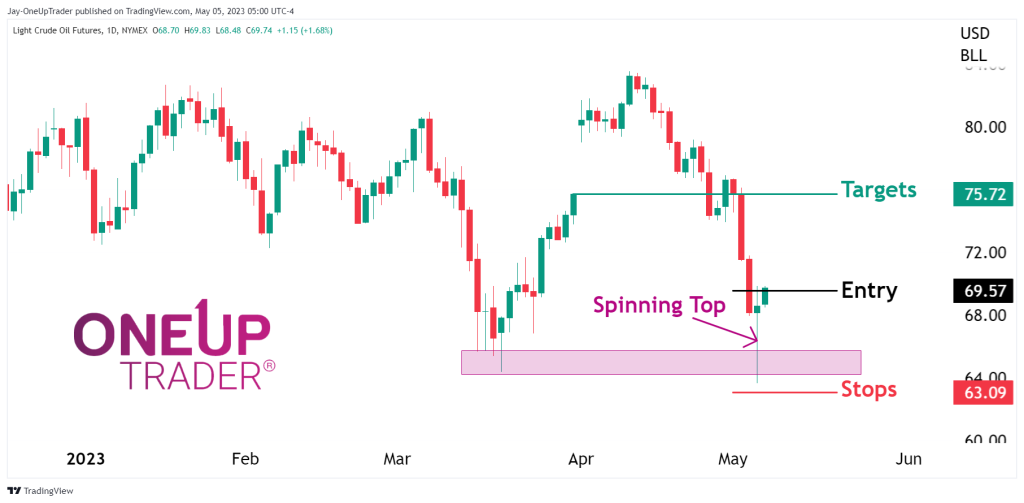

CL remains within the range we have been monitoring in almost every article this year made on crude futures. This range refuses to be broken in either direction. We can keep the technical analysis very simple with this trade as a huge spinning top has formed at the bottom of a 3-week sell-off.

As shown in the daily chart above, not only is the spinning top formation at the bottom of a sell-off, it has also formed a double bottom. This gives perfect placement for stop losses for long trades. This type of setup is a high probability setup, but we should give the stops some room. In the image above, I placed a stop at $63.09, but it really should be placed anywhere below that number.

Bulls who want an even higher risk-reward ratio on their trade can take the risk of not entering into the position now in anticipation of a small pullback into the bottom side of the spinning tops wick and go long that way. There is, of course, the chance then that these traders do not get filled, but it will drastically improve the risk-reward ratio than entering now.

Targets can initially be set at the Gap we mentioned last week at $75.72. Traders can take half the size at that point and then leave something in case of a big run.