Introduction In our earlier analysis, I mentioned key levels in CL crude futures, focusing on a support zone between $66-$71 and a potential breakout above $78.04. There was an expectation of a rally towards higher targets if the price successfully broke above the descending trendline and the 100-week EMA. With escalating geopolitical tensions involving Iran Read More…

Tag: crude oil futures (CL)

Oil Prices Surge as Middle East Tensions Fuel Supply Worries

Oil prices have rallied since Wednesday due to supply concerns stemming from increased tensions in the Middle East. However, a build in US crude inventories indicated weak demand, weighing on prices. Brent futures (Source: ICE) The conflict between Iran and Israel escalated when Iran fired 180 missiles at its opponent. Meanwhile, Israel vowed to hit Read More…

Crude Oil prices up 6% on Middle East tensions, technicals point to $78 target

Fundamentals WTI crude futures rose 1.56% to $70.92 per barrel late Tuesday as fears of oil supply disruptions grew after Iran launched ballistic missiles at Israel. Iran fired over 180 missiles in retaliation for Israel’s campaign against Hezbollah in Lebanon, escalating tensions in the oil-rich region. ANZ Research noted Iran’s involvement raises concerns about potential Read More…

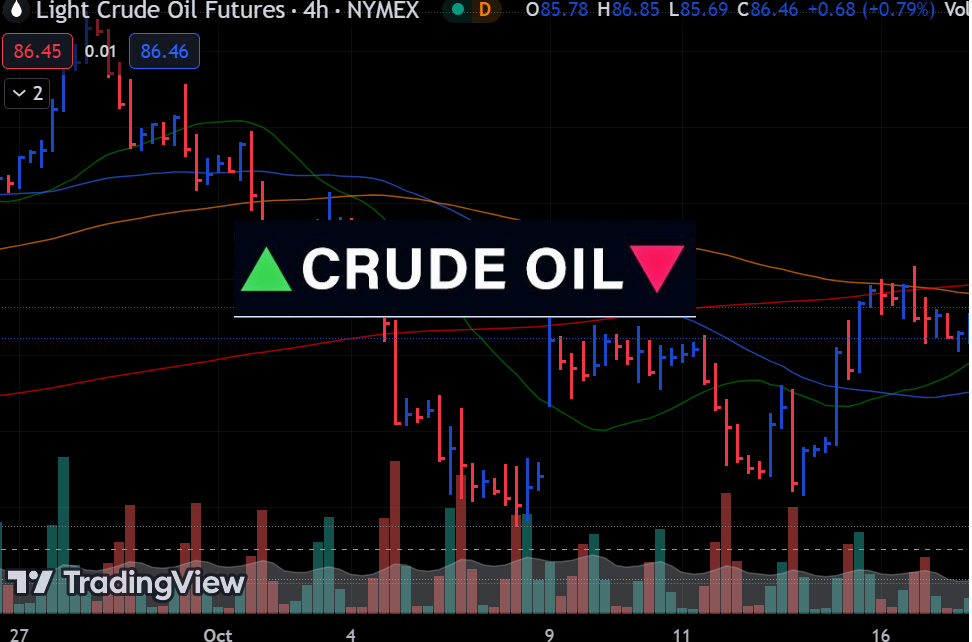

Crude Oil Bears In Full Control (CL FUTURES)

Introduction Crude oil prices have been falling recently due to a combination of factors. One major reason is the slowing demand from China, which has been experiencing economic challenges, particularly in its real estate sector and a growing shift towards electric vehicles. As one of the largest consumers of oil, any slowdown in China significantly Read More…

Oil Slips as Libya Conflict Resolution Calms Supply Concerns

Oil prices fell on Wednesday and Thursday as concerns about supply disruptions in Libya eased after a deal to end the conflict. At the same time, market participants were worried about a planned increase in Saudi Arabia’s oil production. Oil chart (Source: Bloomberg, ICE) Libya, a significant oil producer, had slashed production due to conflict Read More…

Crude Oil Futures (CL) Hitting $80 soon?

Introduction It’s time again to look at the overall picture of CL futures and where we see it heading. The price is still hovering inside the support zone at $68, a level that has been tested and held since the start of 2023. Now, it looks like bulls could be targeting a move back up Read More…