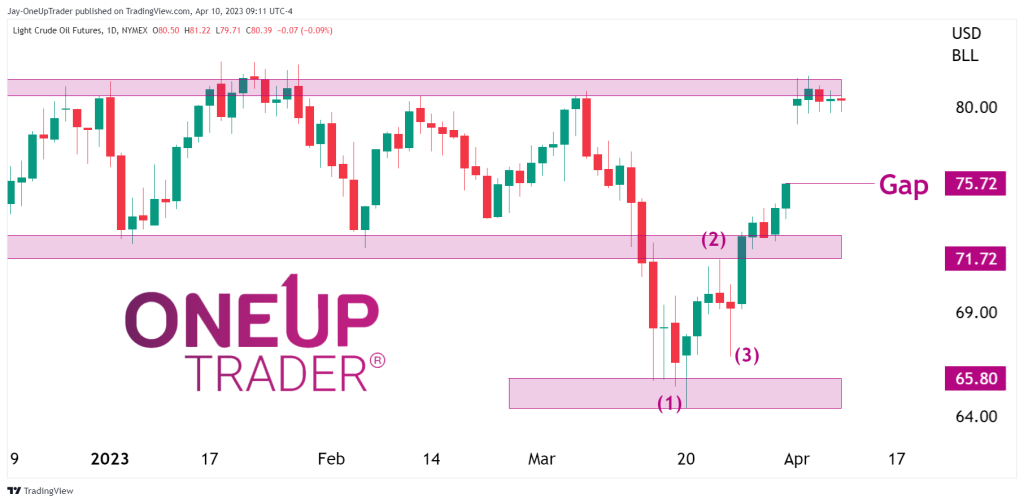

- Price settles at $80 as bulls struggle to push it through a resistance zone.

- There is a price gap at $75.72, which bears are targetting.

Technical analysis

Crude oil futures have been trading at $80 and have been struggling to break out of a resistance zone. This resistance zone has been a major hurdle for the bulls as they attempt to push the price higher. If the price does begin falling below $78, then the bears will likely target the $71 level.

On the other hand, if the price manages to break above the resistance zone at $80, then the bulls will be targeting the $90 level. The bulls will be looking for a sustained break above the resistance zone to confirm the uptrend and to maintain their bullish stance.

One factor playing into the bears’ hands is the resistance zone mentioned above. This zone has proven to be a significant barrier to price movement, and the bears will be looking to capitalize on this weakness. Additionally, there is a gap at $75.72 which the bears will want to fill.

From here, it’s challenging to make a call on the direction of the market. The price action is currently range-bound, and both the bulls and bears are struggling to gain control. The market could continue to trade within this range, or we could see a breakout in either direction.

Traders will be closely watching the price action around the resistance zone and the $78 and $71 levels. A break below these levels could indicate further downside, while a sustained break above the resistance zone could indicate further upside.