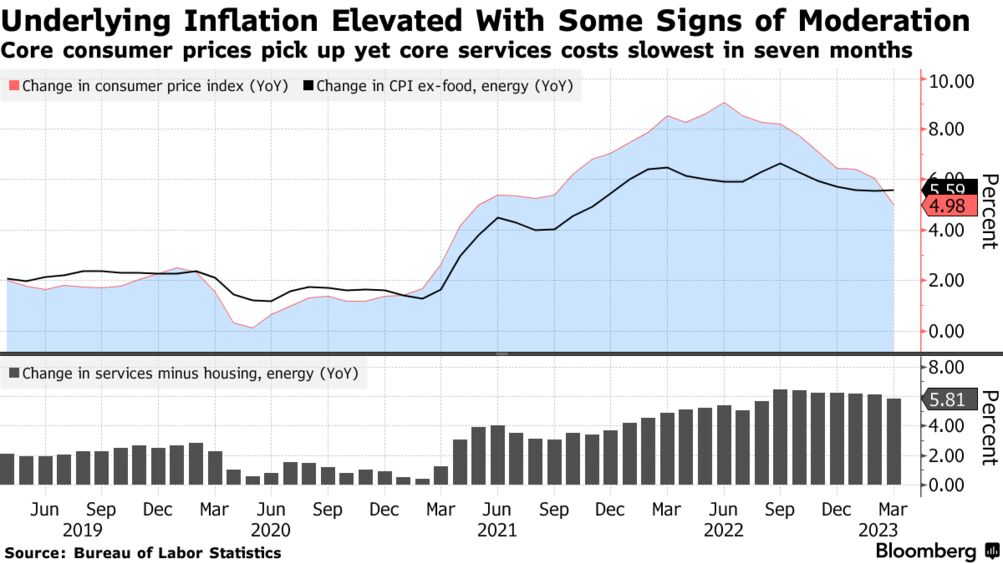

- After increasing by 0.4% in February, the US Consumer Price Index (CPI) increased by 0.1% last month.

- In the most recent week, crude stockpiles increased by 597,000 barrels to reach 470.5 million.

- The IMF revised lower its projection for global growth in 2023.

Oil prices rose by 2% on Wednesday, reaching their highest level in over a month. Cooling US inflation data raised optimism that the Federal Reserve would soon end its cycle of interest-rate hikes. This optimism Overshadowed a slight increase in US crude oil inventories.

After increasing by 0.4% in February, the US Consumer Price Index increased by 0.1% last month, according to the Labor Department. The CPI rose by 5% in the year that ended on March 31, which was the smallest annual gain since May 2021.

According to Fawad Razaqzada, market analyst at brokerage StoneX, “the weaker US CPI report has raised questions over whether the Fed is going to hike rates at all next month.”

The data caused the dollar to plunge significantly. Oil priced in dollars becomes more affordable for buyers using other currencies when the dollar weakens.

Markets dismissed the slight increase in US crude oil inventories, partly due to the congressionally mandated release of oil from the country’s emergency reserve. The increase might have also been due to reduced exports at the beginning of the month.

In the most recent week, crude stockpiles increased by 597,000 barrels to reach 470.5 million, deviating from the forecast of a 600,000-barrel decline. Distillate and gasoline stockpiles did not fall as much as anticipated.

An American Petroleum Institute report showed that oil inventories rose by around 380,000 barrels the previous week, and sources indicated that gasoline inventories increased.

According to Fatih Birol, executive director of the International Energy Agency, the global oil market might get tighter in the second half of 2023, raising oil prices.

On Tuesday, the International Monetary Fund lowered its projection for global growth in 2023. This revision is bad news for the oil demand. The IMF cited the impact of increasing interest rates in its revision.

The market is also waiting for clarification on the demand and supply of oil. The Organization of the Petroleum Exporting Countries and the International Energy Agency have monthly reports due on Thursday and Friday, respectively.