IntroductionThe E-mini Dow Jones (YM) Futures have been exhibiting a consolidation and breakout pattern, as observed in the weekly and daily charts. We must closely monitor these fluctuations to gauge the market’s course as we approach the end of the year. Do you think we will reach all-time highs in equities before year’s end? Let’s Read More…

Technical Analysis

Russell 2000 Futures (RTY) Technical Analysis

The last time we looked at RTY was almost a month ago as the price just broke below a support trend line. Now, the market for small caps has lagged behind the large cap stocks. Let’s do some technical analysis and see if we expect this gap to close or grow wider. Support and Resistance Read More…

S&P 500 Futures (ES) Technical Analysis To Start The Week

Introduction The S&P 500 Futures (ES) exhibit strong bullish signals both on the technical side and on the fundamental side. Price is hovering around $4531, with last week closing up 2.1%. ES is only 6.2% away from all-time highs now, and the question is whether we see new highs before the year’s end? Weekly Chart Read More…

Gold Futures (GC) Rally Again As Bulls Accumulate

Introduction As geopolitical tensions continue to simmer, gold’s status as a safe-haven asset is once again coming to the fore, driving buying interest in Gold Futures (GC). With an eye on the short-term trends, let’s look into the daily chart for a technical view of where GC futures stand. Resistance at the $2019.7 high The Read More…

Crude Oil Futures (CL) Technical Analysis: A Short-Term View

Key Price Levels to Watch: Technical Indicators Overview: Fibonacci Retracements: Potential Market Scenarios: Conclusion As we wrap up our technical analysis of Crude Oil Futures, it’s clear that the market is at a crossroads, with key levels at $74.91, $95.03, and $68.07, offering guidance on potential future movements. Remember, the true skill in futures trading Read More…

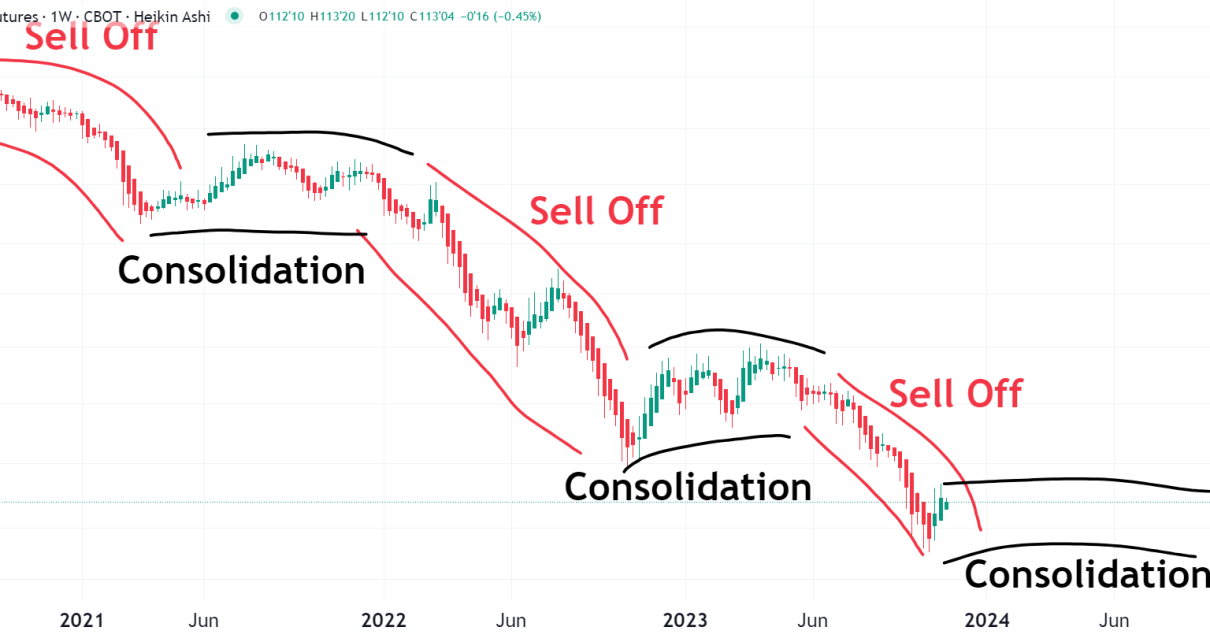

Is The Bond Buying Bonanza Over?

Intro The bond-buying has hit a roadblock for the moment as ZB shows signs of a reversal. On the ZB futures chart, we look at this inversely as bond buying means the chart goes down because yields get less. So for this article, when ‘bullish’ is made as a reference it indicates the chart is Read More…