- Investors await US inflation data.

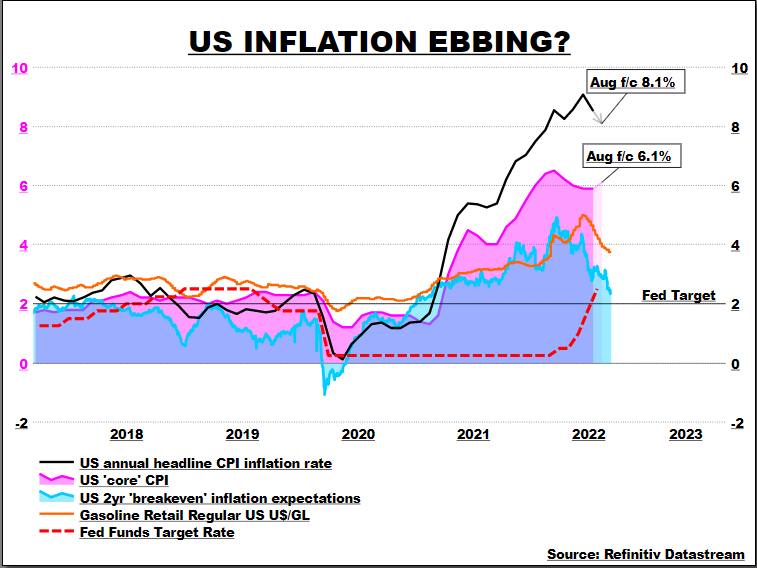

- Inflation in the US is expected to go down to 8.1% year-over-year.

- Markets have priced in a 92% chance of a 75bps Fed rate hike.

E-mini S&P 500 (ES) futures extended gains on Tuesday as investors anticipated critical inflation data that could offer hints regarding the size and pace of the Federal Reserve’s tightening strategy.

“CPI is expected to see a little bit of a decrease,” said Robert Pavlik, senior portfolio manager at Dakota Wealth in Fairfield, Connecticut. “The market hopes this news translates into smaller rate hikes after the Sept FOMC meeting.”

“Because of that, you’re seeing a risk-on mentality today,” Pavlik added.

According to economists surveyed by Reuters, the monthly CPI will have decreased by 0.1% from July to August, sliding down to 8.1% year-over-year, primarily as a result of the recent cooling of commodity prices.

The chart above looks at the correlation between US inflation and gasoline prices. Inflation expectations have decreased with low gasoline prices, resulting in lower inflation.

According to CME‘s FedWatch tool, the financial markets have priced in a 92% chance that the Federal Open Markets Committee (FOMC) will execute its third consecutive 75-basis-point interest rate hike after next week’s policy meeting.

“The market has now fully priced in 75 basis points for September,” Pavlik said. “The market hopes the next one is 50 basis points, and we’ll see a slight decrease in rate hikes after that, and Wall Street can live with that.”

However, as quantitative tightening picks up, some investors are reducing their exposure to equities or fixed income. They are concerned that the process, combined with other variables like higher interest rates and a surging dollar, could further impact asset values and harm GDP.

“The economy is already on a glide path to a recession, and the Fed’s quickening pace in terms of QT will accelerate the decline in stock prices and increase in bond yields,” said Phil Orlando, chief equity market strategist at Federated Hermes.

Stocks and bonds have suffered in 2022 due to the Fed’s tighter monetary policy. The yield on the benchmark 10-year US Treasury recently stood at 3.30%, after surging 182 basis points this year. The E-mini S&P 500 (ES) futures prices have declined by 14.6% this year. Some investors are hoping lower inflation in the US will reverse these losses.