- Investors keen on the Fed minutes on Wednesday at 13:00 CT

- The E-mini Nasdaq (NQ) futures is up 23% from the June 16 lows

- Bulls seem to be in control, with $14, 200 as the target

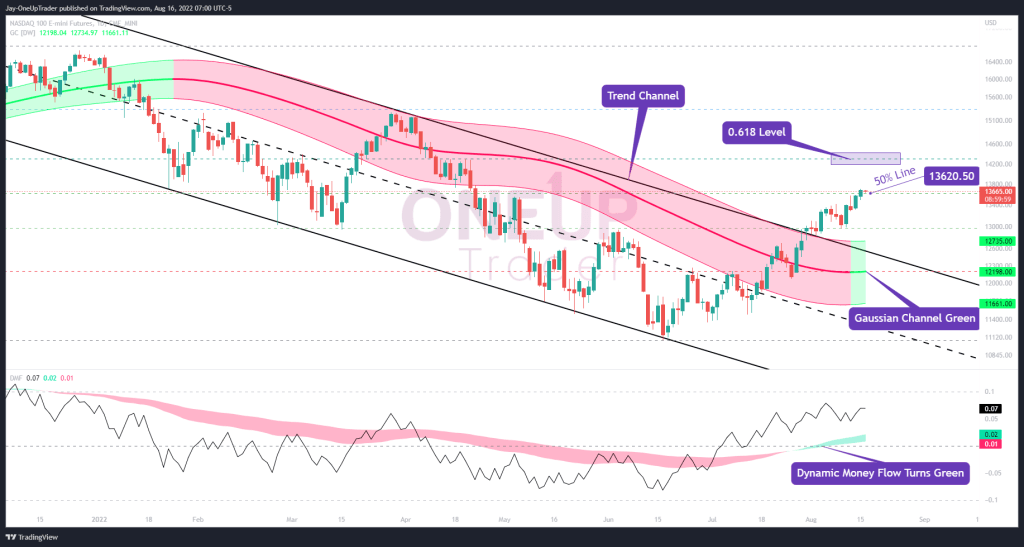

Since the Nasdaq made its lows on June 16th, we have seen a strong move to the upside with small retracements being bought up within a few days. Our downward trend channel has now been officially broken to the upside with the argument of a dead cat bounce losing more and more strength each day the rally continues.

Bulls are in total control as the market awaits the Fed minutes coming this Wednesday. The meeting will give a better picture of whether the Fed will continue with aggressive rate hikes of 75 basis points or take a more dovish stance of 25 or 50 basis points for the remainder of the year.

The Gaussian Channel and Dynamic Money Flow moving averages have also turned green for the first time in 6 months further adding to the bullish momentum.

The volatile index is currently trading at $13,669 which is 50% of the down move from the high of November 22. As there are no current signs of sentiment changing from bullish to bearish, our targets are $14,300 which is the next Fibonacci level of 0.618.

As traders and investors wait to hear what the Federal Reserve’s monetary stance will be on Wednesday, markets are at risk on with the Nasdaq 100 futures well off its low of $11,071.