Introduction

Based on the latest inflation data, the U.S. dollar is likely to remain stable or potentially strengthen in the near term. The slowing but steady inflation rate, coupled with the Federal Reserve’s decision to maintain interest rates at their current elevated level, could make the dollar more attractive to investors seeking a safe haven.

We are seeing this play out in the Euro FX (6E) chart as the price looks overbought in the short term. Lets see what the technical analysis tells us.

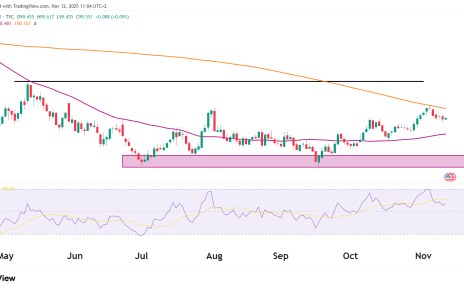

Daily Chart

The daily chart above still shows a very big head-and-shoulders pattern that could play out, as we mentioned in our previous technical analysis of the Euro futures. The most significant feature is the stochastic, which is overbought. In a ranging market like we see in 6E, the stochastic can be a very reliable indicator. Does this mean it retraces all the way down to the support zone?

Trades

Taking shorts at current levels while targeting a small 1;1 risk reward ratio, or possibly a retracement down to the support zone.

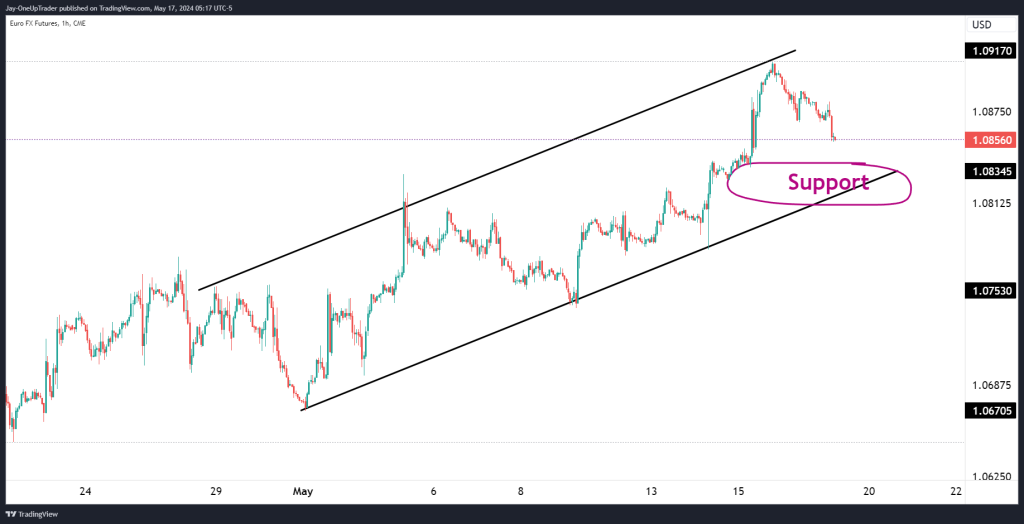

It is possible that we see 6E come back down slightly but just continue its shorter-term uptrend as seen on the 1 hourly chart below.

Bears need to see this trend channel break to the downside.

Bulls can wait for confirmation that support will hold at 1.08345 and then initiate a long position.