Introduction

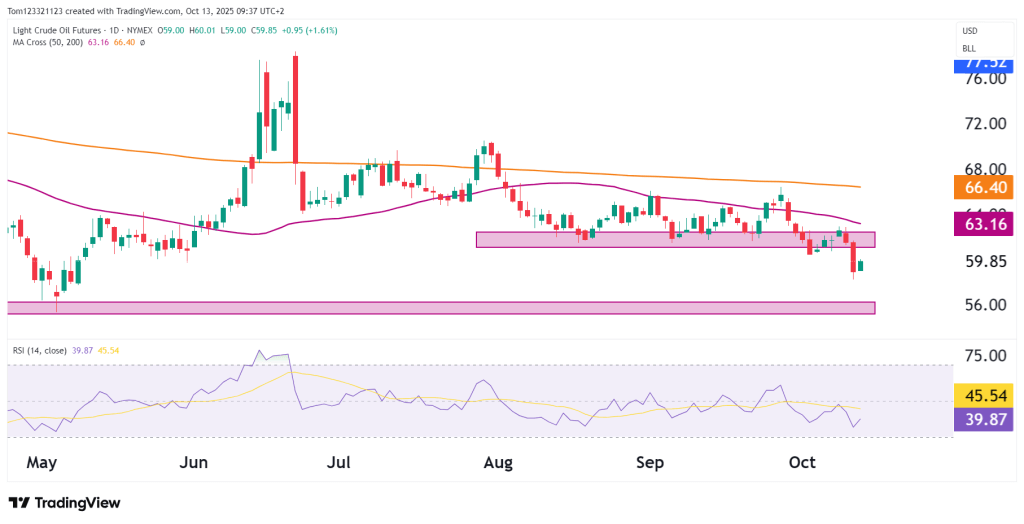

Last week, we looked at Crude Oil (CL) Futures, which were testing the support zone between $62.4 and $61. The sideways price action, which was dominating, could be coming to an end as the sellers found the strength to push the price below the level, falling 4.24% on Friday, its biggest drop since June. Price is slightly clawing itself back after Friday’s sell-off, and the previous support zone has now turned into resistance. Bears are eyeing the next zone at $56, so let’s take a closer look at the technicals and fundamentals and what they are telling us.

| Type | Level | Description |

|---|---|---|

| Immediate Resistance | $61–$62.4 | Former support, now resistance |

| Major Resistance | $66.40 | 200-day moving average |

| Support 1 | $59.00 | Short-term hold zone |

| Support 2 | $56.00–$56.50 | Major target for bears |

| Deeper Support | $54.00 | Long-term retracement zone |

Fundamentals

Crude oil prices have dropped recently due to a mix of market caution, a stronger U.S. dollar, and worries about weak global demand. Even with tensions in the Middle East, the market is paying more attention to slowing demand in Asia and unexpectedly high U.S. oil stockpiles.

At the same time, U.S. oil production is still high, adding to the supply glut. Traders are watching the Iran–Israel situation and how strictly OPEC+ sticks to its output limits to see if deeper cuts might be needed to boost prices.

Ending Off

The break below the $61 support zone on Friday has shifted CL into a bearish tone, and the sellers are looking to target the $56 zone. $61 has turned from support to resistance, and price will need to break back above this level for there to be a shift in sentiment again. Consolidation is still a possibility, but the next few days will be pivotal in shaping this.

________________________________________________________________________________________________________________

This analysis is for educational and informational purposes only and does not constitute trading advice or a recommendation to buy or sell any futures contracts. Futures trading involves significant risk and may not be suitable for all investors. Always conduct your own research and consult with a licensed financial professional before making trading decisions.