- Investors are optimistic the Fed will pause rate hikes as the US economy cools.

- Business activity in the US fell further below 50 in October.

- 74.7% of the S&P 500 businesses have reported higher-than-expected earnings.

E-mini S&P 500 (ES) futures prices rose on Tuesday, building on gains from the previous week. Indications of economic slowdown suggested that the Fed’s aggressive monetary policies regarding rate hikes and containing decades-high inflation are starting to have an impact.

S&P Global’s report on business activity this month revealed a decline, hinting that the Federal Reserve’s onslaught of sharp interest rate rises has the desired effect. This gave rise to optimism that the central bank may start reducing the rate at which it raises the Fed funds target rate.

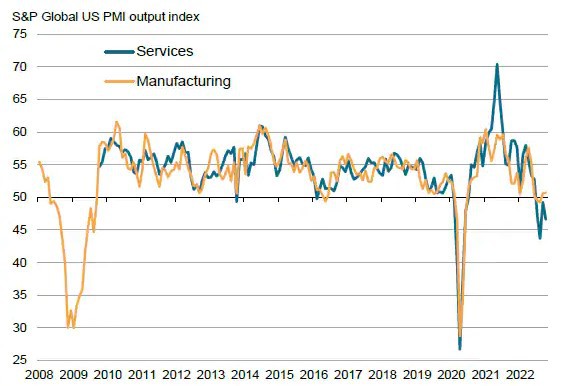

S&P Global reported on Monday that its flash US Composite PMI Output Index, which monitors both the manufacturing and services sectors, dropped from a final value of 49.5 in September to 47.3 this month.

A reading below 50 implies that the private sector is contracting. Business output has been declining at a faster rate since the 2007–2009 global financial crisis, according to S&P Global’s gauge, except for the dip during the COVID-19 pandemic in the spring of 2020.

“It’s a sign the economy is slowing down, and what the Fed is doing is working,” said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia. “They may be achieving their goal, and we might be approaching the fourth quarter of rate hikes, to use a football analogy.”

This week, the third-quarter earnings season kicks into high gear. Nearly one-fifth of the S&P 500 businesses have reported thus far. Refinitiv data show that of those, 74.7% have produced results that have exceeded expectations.

Elsewhere, Chinese enterprises with US-listed stocks experienced a sharp decline on Monday due to investor worries that President Xi Jinping’s new leadership team would prioritize ideology above private sector growth.

The E-mini S&P 500 (ES) futures prices have gained over 9% since the bottom on October 13, despite increasing bond yields and prospects for higher interest rates. The new uptrend might continue if earnings keep surprising.

However, factors that might make investors cautious include worries about liquidity and financial stability, political, economic, and market trends in China, Japan’s policy snags, FX market interventions, and market and political turmoil in the United Kingdom.