- Investors exercised increased caution in anticipation of the US consumer price index report.

- The ongoing discussions regarding the US debt ceiling contributed to market apprehension.

- Peter Kazimir acknowledged that the ECB might need to maintain higher interest rates for longer.

US equities dipped on Tuesday as investors exercised increased caution in anticipation of the US consumer price index report. Investors were also awaiting a meeting between US political leaders to discuss the debt ceiling.

The Labor Department’s consumer price index (CPI) report will come out on Wednesday, and investors will closely analyze it for any signs of continued inflation reduction.

The ongoing discussions regarding the US debt ceiling contributed to market apprehension.

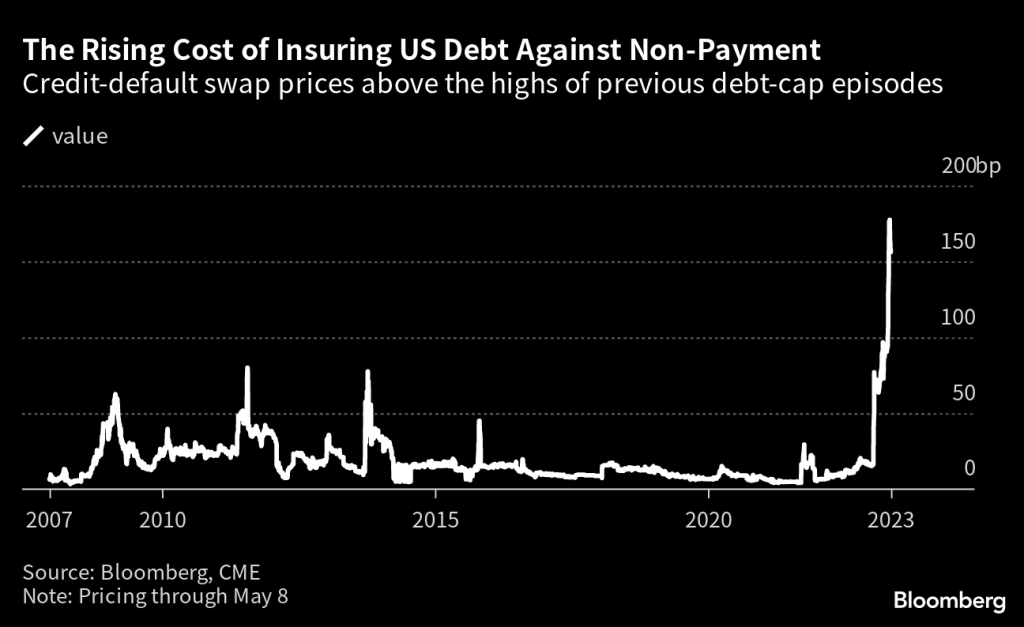

Traders awaited an update on the plans for the debt ceiling from a meeting held at the White House. The meeting was between US President Joe Biden, Republican House Speaker Kevin McCarthy, and other congressional leaders. The cost of insuring US debt has risen sharply.

Washington faces the looming concern of a potential government default as early as June 1 if Congress fails to resolve the deadlock. Additionally, disappointing forecasts from major companies, including PayPal and Apple supplier Skyworks, contributed to negative market sentiment.

The benchmark S&P 500 was adversely affected by PayPal Holdings’ decreased margin forecast, causing it to drop. The company’s shares were also among the top contributors to the decline of the Nasdaq.

Similarly, Skyworks Solutions Inc’s shares experienced a decline after the company forecasted lower-than-expected current-quarter earnings.

European equities ended lower on Tuesday due to weak corporate earnings reports, which hurt risk appetite. Investors were awaiting critical US economic data to gain more clarity on the Federal Reserve’s monetary policy plans.

Despite a 9.4% year-to-date gain, the benchmark STOXX 600 index has recently faced downward pressure. This is because the European Central Bank remained unwavering in its efforts to combat price pressures.

Policymaker Peter Kazimir acknowledged that the ECB might need to keep rates higher for longer than initially expected. Additionally, he said September was the earliest opportunity to evaluate the effectiveness of current policy-tightening efforts.

Markets predict an additional 40 basis points increase in the European Central Bank’s 3.25% deposit rate. This indicates that investors anticipate another move but are divided on subsequent steps. Some investors even foresee rate cuts in early 2024.

Most European bourses experienced a slight decrease, and London’s FTSE 100 dropped by 0.2% following a prolonged weekend.