- Powell stated that the US central bank may not need to lift interest rates as much.

- The dollar faced pressure from a pause in negotiations regarding the US debt ceiling.

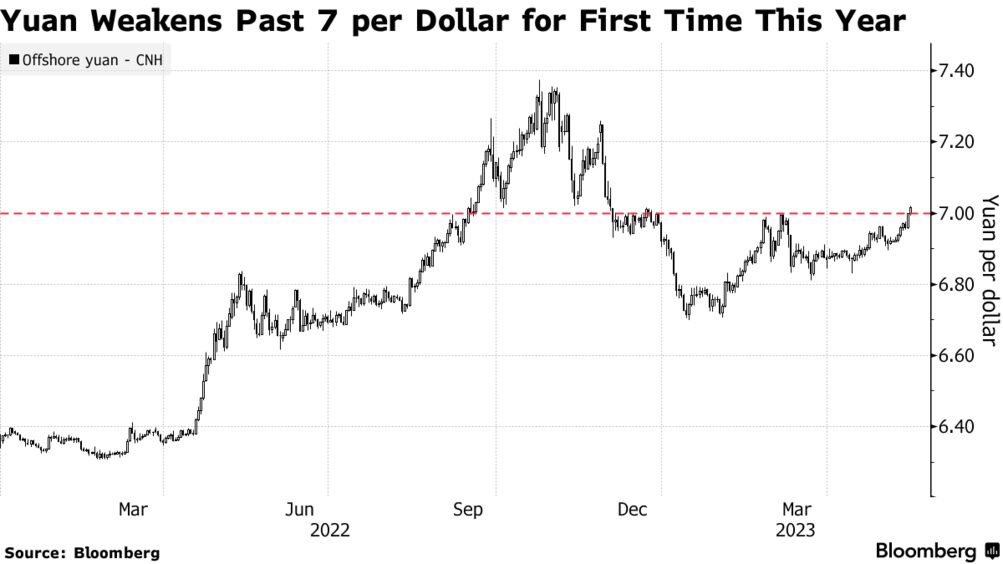

- The Chinese yuan experienced a decline, reaching its lowest level since December.

Most currency futures rose on Friday as the dollar dropped due to Federal Reserve Chair Jerome Powell’s unexpected dovish stance. Contrary to market expectations, Powell stated that the US central bank might not need to raise interest rates as much, considering the tightening of credit conditions.

Additionally, the dollar faced pressure from a pause in negotiations regarding the federal government’s $31.4 trillion debt ceiling.

Powell’s remarks at a central bank conference in Washington caught the market off guard. He highlighted that tighter credit conditions imply that the Fed policy rate may not need to rise as much as it would have otherwise to achieve the central bank’s goals.

Furthermore, Powell reiterated that the central bank would now make policy decisions “meeting by meeting.” He emphasized the importance of carefully assessing the economic outlook following a year of aggressive rate increases.

Earlier in the week, Fed officials resisted the idea of pausing interest rate hikes in June due to persistently high inflation. Powell’s remarks impacted the rate futures market, with the probability of a 25bps rate increase in June dropping to approximately 16% from nearly 40% before his speech.

Consequently, the dollar index declined by 0.4% to 103.08, following the previous session, where it reached a seven-week high. It, however, recorded a weekly gain of 0.6%.

Meanwhile, the euro experienced a 0.3% increase, reaching $1.0806, but still posted a weekly decline of 0.8%. Against the yen, the dollar slipped by 0.7% to 137.76 yen, although it had previously reached a six-month peak of 138.745. It recorded a 1.7% gain for the week, marking its largest weekly percentage rise since mid-February.

Additionally, negotiations to raise the $31.4 trillion debt ceiling between US House of Representatives Republicans and Democratic President Joe Biden’s administration were temporarily halted. While the White House expressed the possibility of a future deal, this development weakened the dollar.

In the offshore market, the yuan in China experienced a decline, reaching its lowest level since December at 7.0752 per US dollar. This occurred as data emerged, providing evidence of a faltering recovery in the world’s second-largest economy.