- The US dollar declined after the October jobs report showed signs of “softening.”

- The unemployment rate in the US rose to 3.7% in October.

- Canadian jobs figures came better than expected, creating further room for the bulls.

The Canadian Dollar (6C) futures prices are climbing higher as the CAD strengthens against the US dollar. The catalyst for this move is the weakening of the US dollar across the board after the Nonfarm payroll report. The US October jobs report, released on Friday, showed that businesses added 261,000 more positions, higher than the forecast, while hourly wages continued to grow, showing that the labor market is still tight.

But hidden beneath the surface were hints of the “softening” that Federal Reserve officials believe will be required to curb inflation. This is why the dollar is declining, allowing Canadian dollar futures prices to climb.

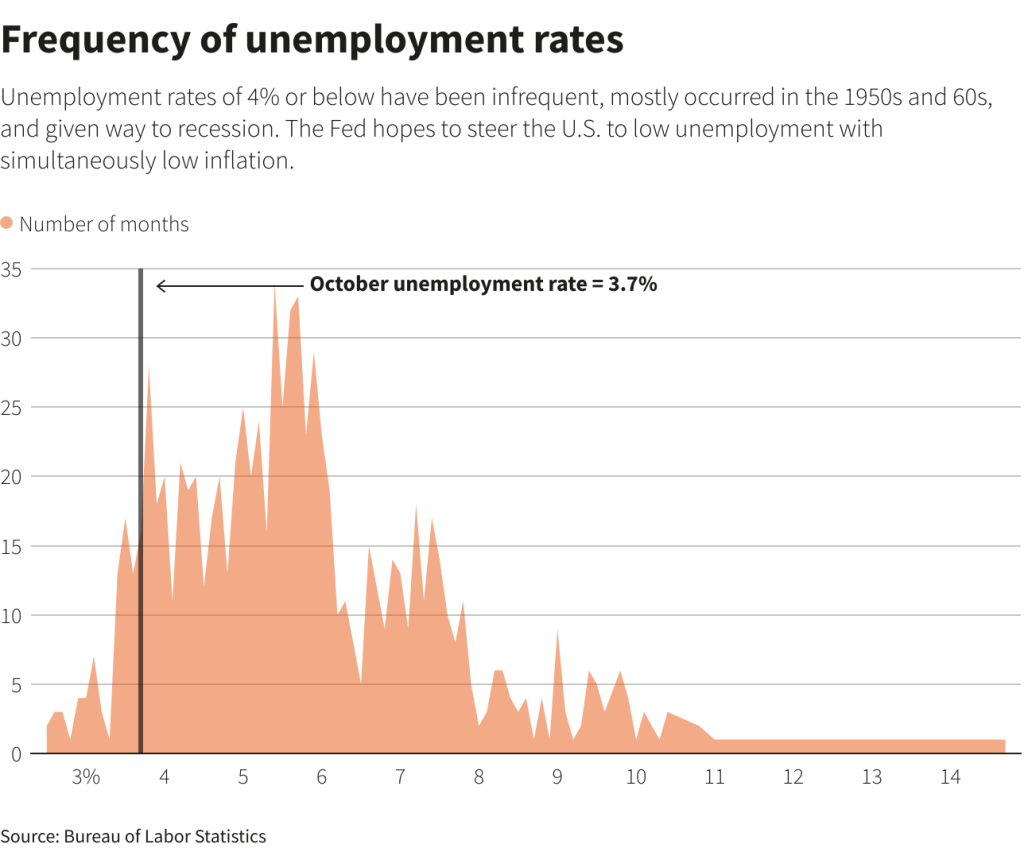

The number of unemployed people climbed in September by 306,000 to just over 6 million. It translates to a 3.7% unemployment rate, which many economists argue is close to or possibly even below sustainable full employment.

However, the number of unemployed people has increased in two of the last three months, with October’s growth particularly noticeable. More than 1.6 million people lost their jobs last month, an increase of roughly 300,000, higher than the 1.5 million monthly average for the previous 12 months. A loose labor market shows the Fed is achieving its goal of lowering inflation.

According to Statistics Canada, the economy added 108,300 jobs during the past month, which is more than what was predicted. The unemployment rate has remained unchanged at the previous level of 5.2 percent.

A week after the Bank of Canada stunned markets by raising interest rates by less than 50 basis points, estimated to reach 3.75 percent, better-than-expected employment statistics were released, signaling that a tightening cycle is getting close to its peak. It is very evident that there is a demand for additional work.

Economists claim that Canada’s intention to spend an additional C$6.1 billion ($4.5 billion) over the next five months demonstrates an effort by the central bank to frustrate inflation control, despite Treasury Secretary Chrystia Freeland’s pledge to keep the monetary policy problem simple.

The Bank of Canada is anticipated to raise interest rates by half a percentage point on December 7th, based on the current state of the financial markets. Despite dropping from 8.1 percent to 6.9 percent, Canada’s inflation rate is still much higher than the Bank of Canada’s goal rate of 2 percent.