- The recent easing in Middle East tensions has lowered the risk of the war entering Iran.

- Data revealed that US business activity fell to a 4-month low in April.

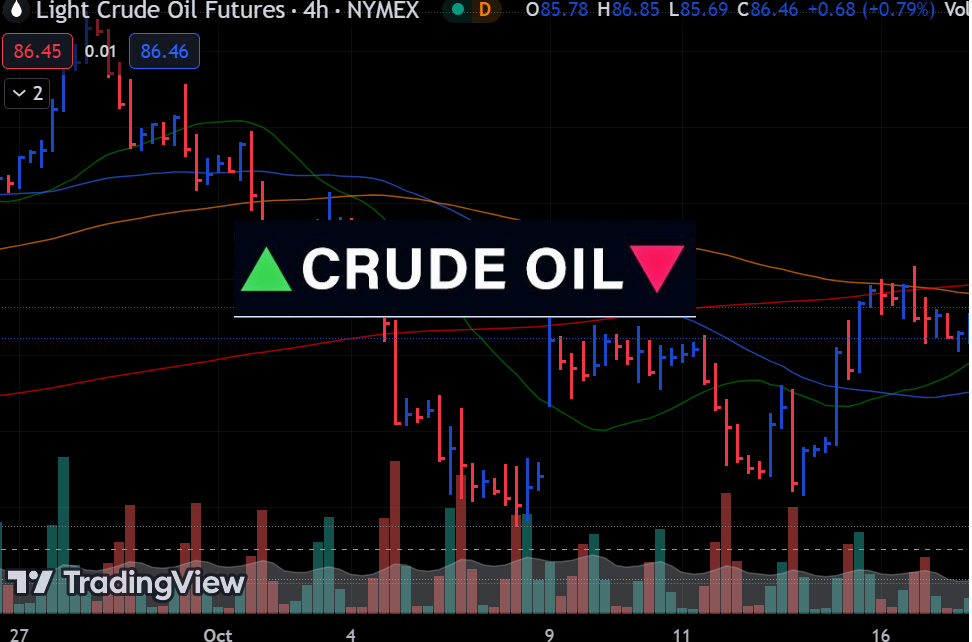

- US crude stocks fell by 6.4 million barrels last week.

Oil prices fell on Wednesday as investors shifted their focus from Middle East tensions to demand concerns. This shift came as the risk of an escalation in the conflict between Israel and Iran fell. Meanwhile, poor economic data from the US raised concerns about weak demand in the country.

WTI, crude inventories (Source: Bloomberg, EIA)

The recent easing in Middle East tensions has lowered the risk of the war entering Iran, a major OPEC producer. Such an occurrence would have caused a bigger rally in the oil market due to a disruption in oil supply. This, in turn, would have tightened the market significantly. However, since Iran said it would not continue attacking Israel, oil has declined as investors focus on the demand side.

Still, the effects of the war will likely continue to be felt as Israel intensifies its attacks against Hamas. The war in Gaza got worse on Tuesday with increasing strikes. At the same time, Israel plans to evacuate Rafah as it plans another attack on the city. As long as this war continues, there will always be a risk of escalation, which will keep traders alert.

The risk-off mood overshadowed bullish momentum after the EIA reported a significant decline in US crude inventories. Stocks fell by 6.4 million barrels last week, beating forecasts for an increase. This was a sign of increased demand for oil. Experts believe the decline came from a big surge in crude exports.

Elsewhere, recent data from the US raised concerns about demand in the US, a major oil consumer. A report by S&P Global revealed that US business activity fell to a 4-month low in April. A decline in business activity translates to a drop in demand for oil, at least in the short term.

However, it could allow the Fed to lower interest rates in the long run, reviving the economy’s demand. Fed policymakers are looking for any signs of a slowdown in the economy. Decreased demand leads to further declines in inflation, giving them the confidence to cut interest rates. However, if demand remains high and inflation is hot, the central bank will keep pushing back the timing of the first rate cut.