The Bank of England (BoE) might push the UK economy into a depression with rising interest rates. According to a Reuters poll, the Bank of England will raise borrowing costs by a further 50 basis points (bps) starting next month before reducing the rate to a more typical 25 bps increase in November and then halting.

The Bank hiked interest rates earlier this month by 50 basis points, the biggest in 27 years, to rein in inflation predicted to reach double digits.

The substantial hike is anticipated despite official figures indicating the GDP shrank by 0.1% in the most recent quarter and predictions from the central bank that the nation will probably go into recession later this year and not come out of it until early 2024.

“With growth slowing, it is tempting to assume the BoE will be thinking of hitting the brakes – and could even be cutting rates within the next year. But for now, at least, the UK’s problems are supply and inflation driven: allowing inflation to rise even further risks only making the situation worse,” said Elizabeth Martins at HSBC.

According to the median estimate, interest rates should end the year at 2.50% and remain there until 2024, when they’ll be reduced.

That is despite the recession’s potential, with the median forecast for one occurring within a year being 60% and within two years being 75%.

“We expect a recession in 2022/23 to be driven by high inflation, with a contraction in real consumer spending at its epicenter,” said Ruth Gregory at Capital Economics.

At the September meeting, the BoE will decide whether to raise rates for a second straight time by focusing on Tuesday’s jobs report and Wednesday’s inflation report.

According to the Bank of England, the rate will reach 13.3% in October, the highest level since 1980.

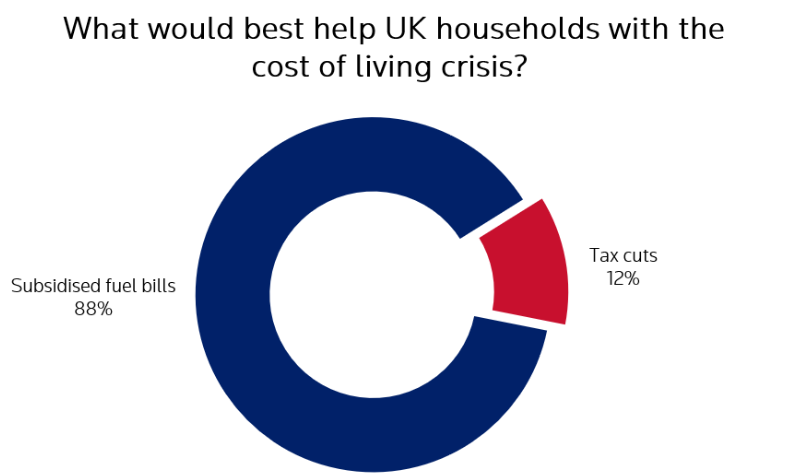

There has been a cost-of-living crisis as a result of rising energy prices, concerns about the UK’s exit from the European Union, and disruptions to supply chains.

Conservative Party leader and prime minister candidate Liz Truss announced earlier that she planned to review the Bank of England’s political powers.

The inflation concern and political turmoil may create a chaotic scenario that can weigh down the British pound. Hence, we can expect a negative outlook for the pound in the coming weeks.