- A surprise drop in gasoline stocks indicated an increase in demand.

- Middle East tensions pose a threat to oil supply.

- Fed’s Susan Collins said that the Fed might start cutting rates later in the year if the US economy performs as she expects.

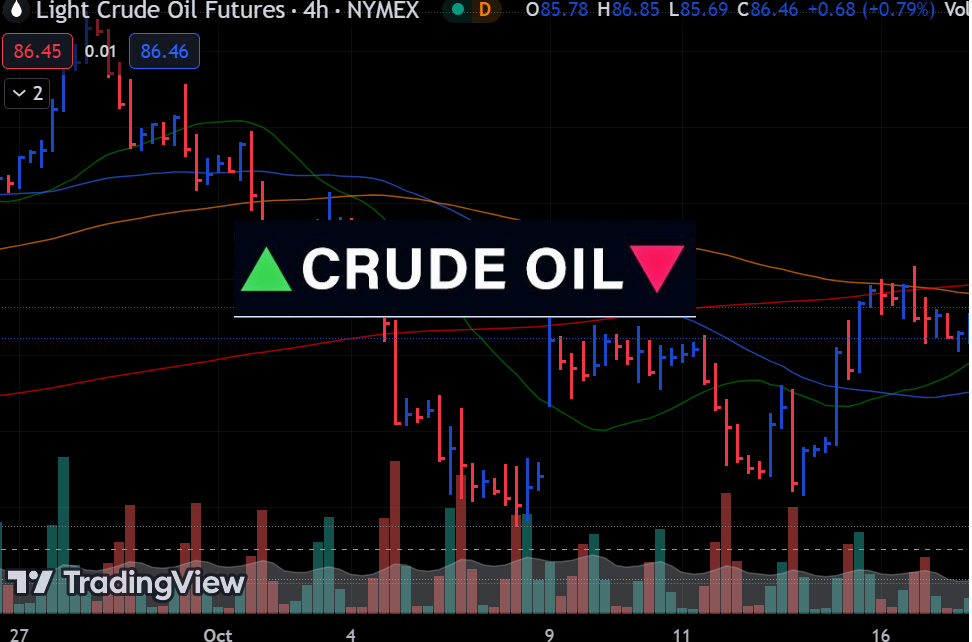

Oil prices rose on Wednesday due to rising tensions in the Middle East that could lead to tighter supply. At the same time, a surprise drop in gasoline stocks indicated an increase in demand.

Aggregate open interest in crude (Source: ICE, CME)

Investors are buying more oil futures, expecting tighter supply and higher prices. Israel rejected attempts at a ceasefire from Hamas, saying they would continue the war until they won. This indicated that the conflict in the Middle East would continue. Israel’s Prime Minister Netanyahu is on a mission to destroy Hamas. Meanwhile, Hamas is ready to release hostages and negotiate an end to the conflict. While the US remains optimistic that the two sides can still reach an agreement, the future looks bleak.

At the same time, investors are watching tensions in the Red Sea, which have caused oil supply disruptions. As long as the Gaza war continues, the conflict in the Red Sea will also likely continue.

Meanwhile, the US Energy Information Administration (EIA) released a mixed report on oil inventories. Last week, a larger-than-expected drop in gasoline inventories pointed to increased demand. The figure came in at 3.15 million barrels. Meanwhile, analysts had forecast an increase of 140,000 barrels. However, oil production in the US went up after the cold season, leading to a larger-than-expected build in crude inventories.

The EIA also cut its 2024 outlook for domestic oil output growth. Meanwhile, on demand, the EIA said India will be the most significant contributor to global oil demand between 2023 and 2030. India takes over from China, which is facing economic difficulties. The poor outlook for China’s economy has also hurt the outlook for global oil demand.

Elsewhere, Fed’s Susan Collins said that the Fed might start cutting rates later in the year if the US economy performs as she expects. A drop in interest rates will likely support oil prices as oil demand increases. However, there is still uncertainty about the timing of Fed rate cuts. Therefore, market participants eagerly await Tuesday’s CPI report for clues on the Fed’s policy outlook. A drop in inflation could bring back bets for imminent rate cuts, boosting oil prices.