- Japan’s inflation increased by 2.7% in August.

- The BoJ is pressured to tighten monetary policy as inflation stays above its 2% target.

- The BoJ is looking set to intervene in the yen’s recent declines.

The Japanese Yen (6J) futures price has pushed off its 24-year low. This rise can be attributed to the increase in Japan’s inflation rate to an eight-year high in August. Businesses passed on growing raw material costs driven by the depreciating yen to customers reflecting the economy’s ongoing price pressures.

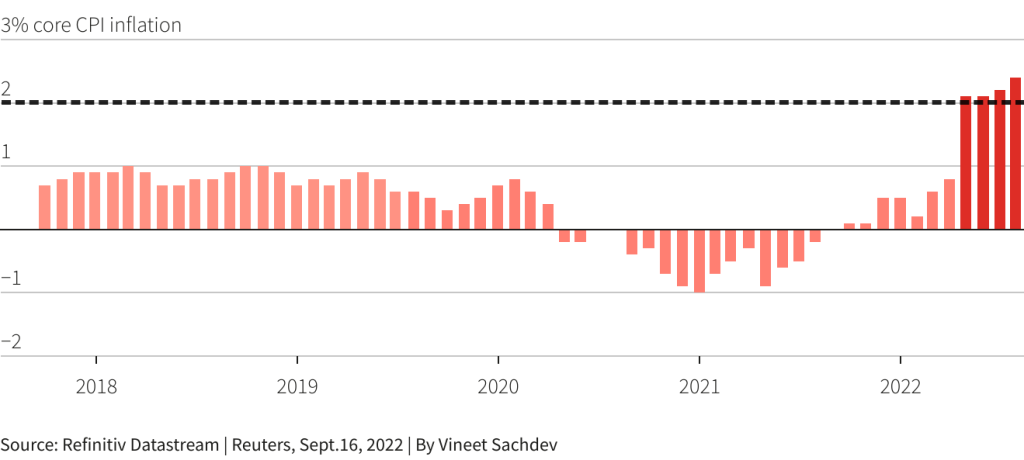

According to economists, the national core consumer price index (CPI), which includes energy but excludes volatile fresh food costs, increased 2.7% last month compared to the same period in 2021. It would be the fastest increase since November 2014 and comes after an annual gain of 2.4% in July.

The BoJ is under a lot of pressure to tighten its monetary policy. This is because inflation has exceeded the stability target of 2% since April 2022.

With the BOJ widely perceived to be clinging to unprecedented easing, the rate differential between the United States and Japan is expected to widen beyond 3%. This could mean a further decline in Japanese Yen (6J) futures prices.

Even Haruhiko Kuroda, the governor of the BOJ who favors a weak yen, was prompted by the currency’s sharp, nearly weekly decline versus the dollar to issue a warning about “unfavorable” swift movements.

Recently, the central bank called lenders to inquire about exchange rates, one of the last stages before a currency intervention. Analysts believe there is little likelihood this will succeed, as the BOJ is mostly to blame for the yen’s depreciation.

Japan has several options, besides verbal intervention, to stop excessive yen falls. One is actively interfering in the currency market by purchasing substantial yen.

Japan has generally focused on stopping rapid currency gains and avoided intervening in yen declines due to the economy’s heavy reliance on exports.

Interventions in the yen market have been quite rare. Japan last intervened to strengthen its currency in 1998, when the Asian financial crisis caused a yen sell-off and a swift exodus of cash from the area.

Currency intervention is expensive and may easily fail, given how challenging it is to influence the value of a currency in the vast global foreign exchange market. This is bad news for Japanese Yen (6J) futures prices.