The long-term 1-2-3 reversal targets are back on the cards Short opportunities on the 30-minute chart. The 1-2-3 Reversal Pattern We must go back to September to view our analysis of the 1-2-3 reversal. Since the market has now broken below recent lows, the bearish target is in play. You can view that article here. Read More…

Tag: oil futures curve

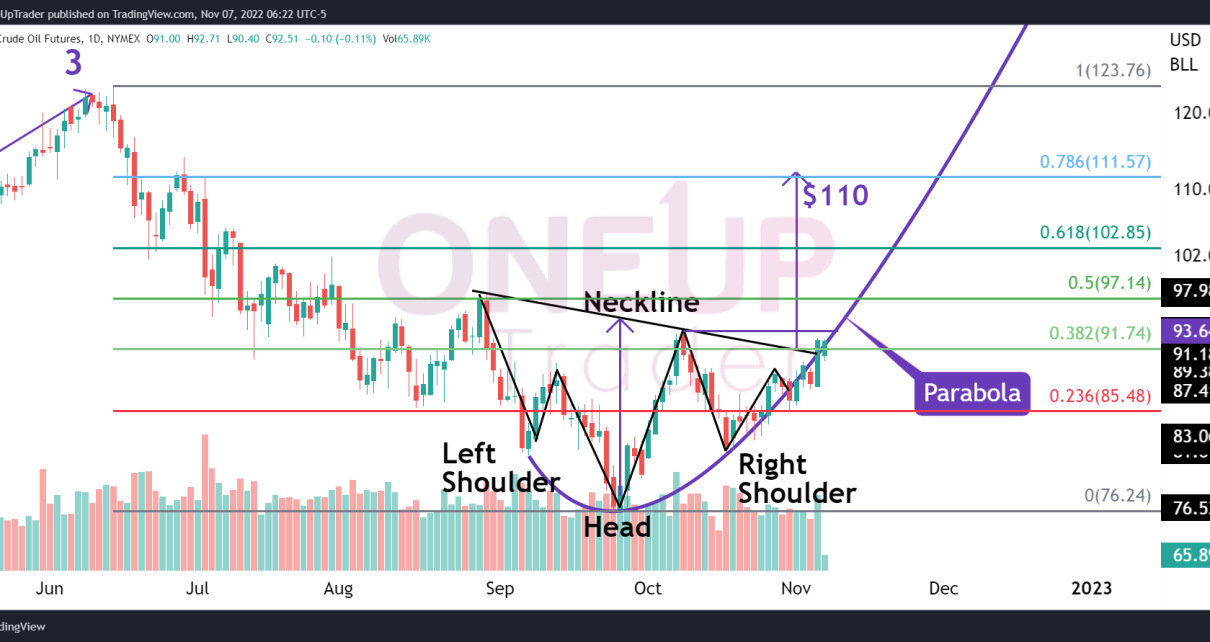

Crude Oil (CL) Futures Forms a Dragonfly Doji On Parabolic Curve

A powerful Dragonfly Doji was formed during yesterday’s volatile session. CL prices bounce off of the Parabolic curve mentioned last Friday. What to expect next? The Parabolic Curve Acts as a Support In yesterday’s volatile session, CL dropped over 6% right into the support zone and the parabolic curve we mentioned in Friday’s technical analysis. Read More…

Technical Analysis: Crude Oil (CL) Futures Prices Consolidating

A Parabolic channel has been identified on the Daily Chart. CL is trading off a support zone at $81.40. Important note on stop placement. Chart Analysis Recap The Head & Shoulders pattern referenced in our CL chart analysis on November 7 did not confirm. The neckline acted as a barricade that the bulls could not Read More…

Rising COVID-19 Cases in China Dampening Oil Demand

There are increasing demand worries as China reports rising COVID-19 cases. Geopolitical tensions have eased after NATO confirmed the Poland missile was an accident. Retail sales in the United States rose more than anticipated in October. Oil prices went down for the second day on Thursday as worries about demand in China, the biggest crude Read More…

Crude Oil (CL) Futures Analysis – Head & Shoulders Neckline Tested

The Neckline of the Inverse Head & Shoulders pattern Daily chart is tested. Fibonacci targets revisited from last week. Price zones to keep in mind while trading today’s session. Quick Recap In our analysis from last week, the Head & Shoulders and Parabola were the main focus. CL price has broken the Parabola, which signals Read More…

Technical Analysis – Crude Oil (CL) Futures Prices Continue to Rally

CL prices continue to follow the Parabola. The Inverse Head & Shoulders pattern has a chance as the price hovers above the neckline. Technicals point toward a bullish sentiment. Fibonacci analysis and targets if the rally continues. Quick Recap In the previous two articles, the central theme has been the bullish sentiment of CL, mainly Read More…