- Fed policymakers were ready to hold high rates for longer as inflation remained stubborn.

- Crude stocks rose by 1.8 million barrels last week, while economists had expected a drop of 2.5 million barrels.

- Citi analysts believe OPEC will maintain current production cuts during the June meeting.

Oil prices fell 1% on Wednesday as investors worried about the risk of high interest rates for longer in the US after hawkish Fed meeting minutes. At the same time, a bigger-than-expected increase in crude inventories weighed on prices.

The US released the FOMC meeting minutes, which showed that policymakers were ready to hold high rates for longer as inflation remained stubborn. Additionally, some policymakers suggested hiking interest rates, raising fears of higher market borrowing costs.

Moreover, it strengthened the dollar, making commodities like oil expensive for overseas buyers. At the same time, high borrowing costs slow economic growth and weaken oil demand. It also means consumers spend less, which has already impacted fuel consumption.

However, this was more of a knee-jerk reaction, which might cool down with time. The minutes showed policymakers’ views after three months of hotter-than-expected inflation figures. Therefore, policymakers are expected to be frustrated with the stubborn inflation.

However, after the meeting, inflation eased in April. Consequently, policymakers might have a slightly different view on interest rates. Nevertheless, they have maintained a cautious stance, awaiting more evidence that inflation is back on its downward path.

If the next report shows more easing, there will be a higher chance of a rate cut at the Fed’s September meeting, boosting oil prices. However, if inflation comes in higher than expected, it would push back expectations for rate cuts.

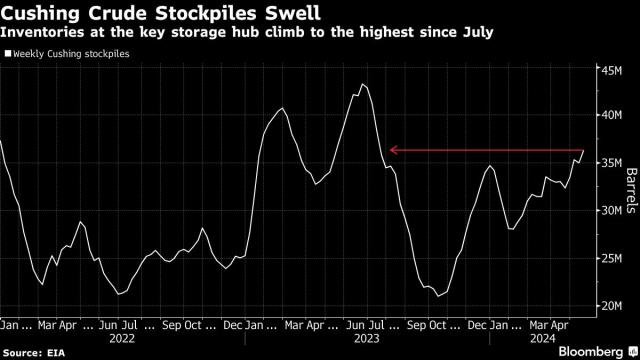

Crude oil inventories (Source: EIA)

Meanwhile, data from the Energy Information Administration showed an unexpected jump in crude inventories, which put downward pressure on oil prices. Crude stocks rose by 1.8 million barrels last week. Meanwhile, economists had expected a drop of 2.5 million barrels. This was a clear sign that demand was weak during the week.

Elsewhere, Citi analysts believe OPEC will maintain current production cuts during the June meeting. Any changes in policy could cause a lot of volatility in the market. Russia reported exceeding its production quota in April but plans to compensate for the error. Increased supply loosens the market and pushes prices lower.