- The greenback received a boost from anticipating a US debt ceiling agreement.

- Robust US economic data reduced expectations of Fed rate cuts this year.

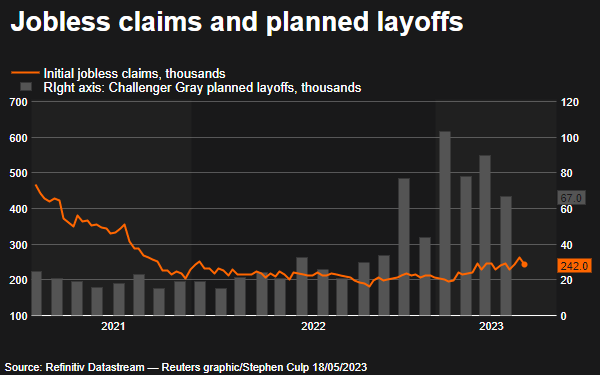

- Data on Thursday revealed lower-than-anticipated US initial jobless claims.

On Thursday, gold prices collapsed as robust US economic data diminished expectations of the Federal Reserve easing. Additionally, gold fell as the greenback received a boost from the anticipation of a US debt ceiling agreement, averting a potential default. A stronger dollar makes for more expensive gold for foreign buyers.

Negotiations between the White House and Republicans took place on Capitol Hill, with plans for further discussions on Friday, as reported by a White House official.

Kevin McCarthy, a prominent Republican in Congress, expressed his expectation of a bill to raise the $31.4 trillion government debt ceiling on the House floor next week. He also highlighted the improved state of negotiations compared to the previous week.

In addition to the debt ceiling talks, investors closely monitored US economic data, which has demonstrated strength in recent weeks.

The reports released Thursday revealed lower-than-anticipated initial jobless claims, with 242,000 claims recorded in the latest week compared to the forecasted 254,000. Another dataset indicated a more moderate-than-expected decline in the Philadelphia Federal Reserve’s manufacturing index. It dropped to -10.4 in May from -31.3 in April. Economists had expected a contraction of -19.8.

Upbeat US data reduces the chances of a Federal Reserve interest rate cut by the end of the year. Following the positive economic data and hopes for a resolution on the debt limit, the 10-year Treasury yield rose, reaching its highest level since March.

The likelihood of the Federal Reserve increasing the benchmark rate by 25bps at its June meeting is currently at around 33%. This marks a notable shift from approximately a month ago when the markets anticipated a 20% probability of a rate cut.

On Thursday, Federal Reserve officials resisted the idea of pausing rate hikes in the coming month, citing concerns regarding persistent high inflation. In particular, Dallas Fed President Lorie Logan highlighted her apprehension about inflation levels remaining “much too high.”

According to her, there hasn’t been sufficient cooling to warrant a pause in the Fed’s interest-rate hike campaign in June. Higher rates for a prolonged time hurt the appeal of gold as it is a non-yielding metal. Despite economic uncertainties, investors prefer the yielding dollar as a haven.