- Gold broke an eight-session losing streak.

- US private payrolls for September fell significantly short of expectations.

- The number of new claims for unemployment benefits in the US increased moderately last week.

Gold rose on Thursday, breaking an eight-session losing streak as US bond yields and the dollar dropped from recent highs. This rise came ahead of the eagerly awaited non-farm payrolls report this week. IG market strategist Yeap Jun Rong commented, “Although there is an attempt at recovery in gold prices today, there is still uncertainty about a complete reversal.”

Any market movements before the US non-farm payroll report this week will likely be short-lived, with the official job data remaining the primary factor influencing market direction. The US CPI data next week will also play a crucial role.

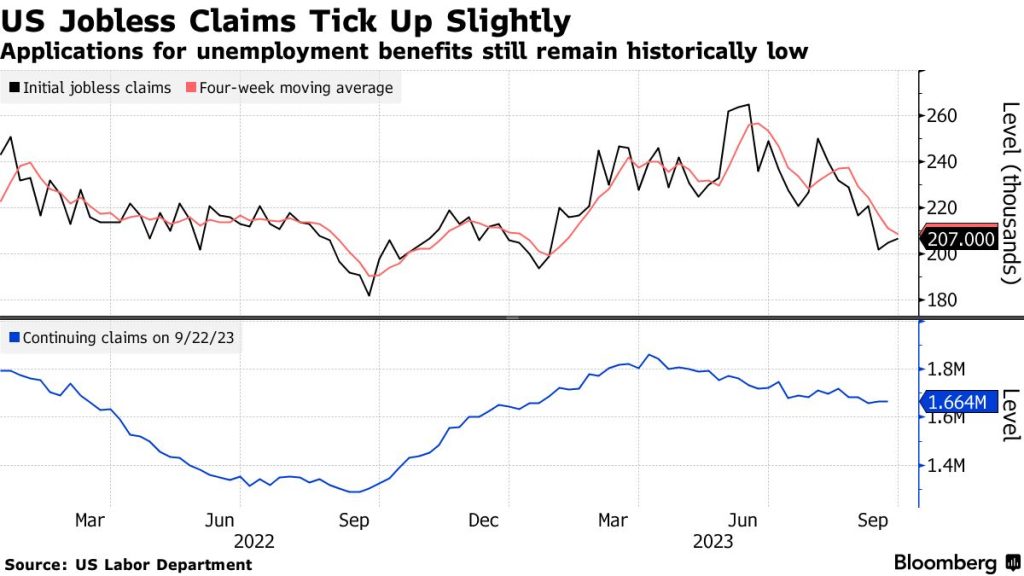

US jobless claims (US Labor Department)

US state unemployment benefit claims data indicated that labor market conditions are still strong. This is despite the recent report revealing lower-than-expected private payroll growth in September. Last week, the number of new claims for unemployment benefits in the US increased moderately, but layoffs decreased in September.

The Labor Department disclosed that initial claims for state unemployment benefits rose by 2,000 to reach 207,000 for the week ending on September 30. Economists surveyed by Reuters had predicted a higher 210,000 claims for the same week.

The most significant economic news of the week will be Friday’s monthly payroll report as investors are concerned about whether the Federal Reserve will maintain higher borrowing costs for an extended period.

At the Economic Club of New York, San Francisco Fed Bank President Mary Daly suggested that the Fed may not need further rate hikes. Furthermore, she noted that US monetary policy was already in a “restrictive” phase. Moreover, the recent increase in US Treasury yields reduced the need for further rate hikes.

On Wednesday, a broad sell-off in global government bonds pushed US 30-year Treasury yields to 5% for the first time since 2007 and German 10-year yields to 3%. The rise in global yields weighs on the non-yielding gold.

The SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, reported a 0.5% decrease in its holdings on Wednesday, reaching the lowest level since August 2019.

The rise in gold on Thursday came as benchmark US 10-year bond yields decreased from their 16-year highs, and the US dollar saw a 0.2% decline.