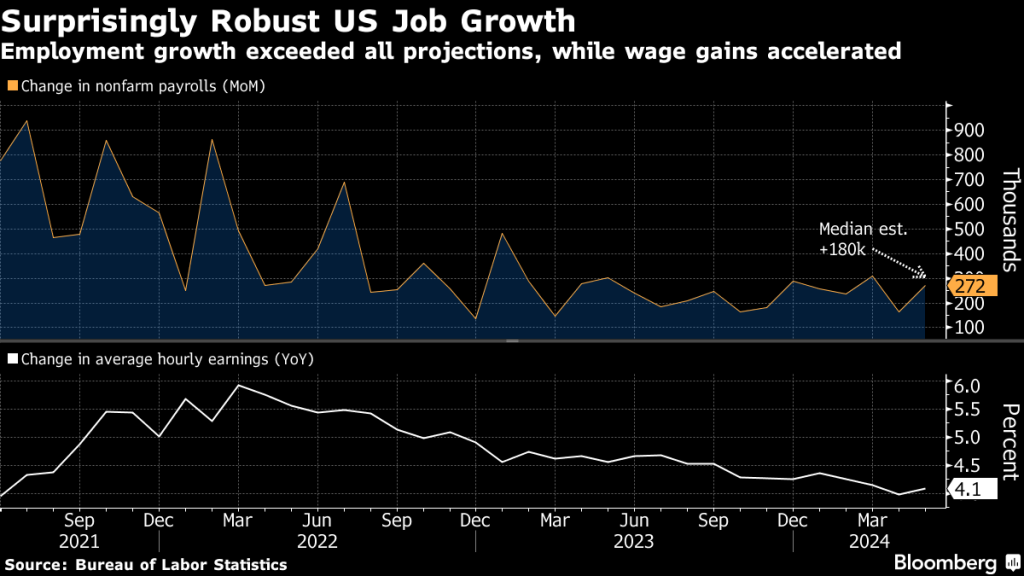

- There was a bigger-than-expected jump in US employment to 272,000 in May.

- The US average hourly earnings figure rose from 0.2% to 0.4%.

- Economists expect the Consumer Price Index report to drop from 0.3% to 0.1% monthly.

Currency futures fell on Friday as the dollar rallied after the US jobs report revealed a still-tight labor market. Most major currencies fell against the greenback as investors scaled back expectations for the Fed’s rate cut.

US job growth (Source: Bureau of Labor Statistics)

Dollar bulls returned to the market on Friday, cheering a bigger-than-expected jump in US employment to 272,000 in May. Economists had expected an addition of 185,000 jobs in the month. This was a significant departure from April when the economy added only a revised 165,000 jobs.

When the April report came out, markets rushed to price, hoping for a bigger chance of a rate cut in September. However, policymakers remained cautious, saying they needed more evidence that the labor market was starting a downtrend. This cautious stance was justified, considering the May report revealed that the labor market remained strong despite high interest rates.

Another indicator of robust demand was the average hourly earnings figure, which rose from 0.2% to 0.4%. However, the unemployment rate, which increased from 3.9% to 4.0%, showed some softness. Nevertheless, there was a sharp decline in rate cut expectations, with market participants only expecting 35 basis points compared to 50 before the report. Meanwhile, the likelihood of a cut in September dropped from nearly 70% on Thursday to 50%.

The jobs report greatly impacted the outlook for rate cuts and will likely shape the messaging at the FOMC meeting. However, before that, investors are awaiting the big inflation test. Economists expect the Consumer Price Index to drop from 0.3% to 0.1% monthly. Meanwhile, the annual figure is expected to hold at 3.4%.

Hotter-than-expected figures will likely erode expectations for a cut in September, pushing the timing for the first cut to November. Moreover, it would increase caution among policymakers, who would take a more hawkish stance. On the other hand, softer-than-forecast inflation would rekindle bets for a cut in September.

The dollar rally on Friday heavily weighed on the euro. This came a day after the European Central Bank became the second major central bank to cut interest rates. Similarly, the Canadian dollar fell despite a bigger-than-expected job increase in Canada.