- The US reported a notable jump in the number of unemployed Americans filing new claims for benefits.

- US producer prices experienced a moderate increase last month.

- Optimism over the Federal Reserve cutting interest rates this year dwindled.

Gold prices fell on Thursday as investors preferred the dollar as a haven amid downbeat US economic data. Even though gold is considered a hedge against inflation and uncertainty, high-interest rates diminish the appeal of the non-yielding asset.

Last week, there was a notable spike in the number of unemployed Americans filing new claims for benefits. This spike, the highest in 1.5 years, reveals weakening demand and cracks in the labor market.

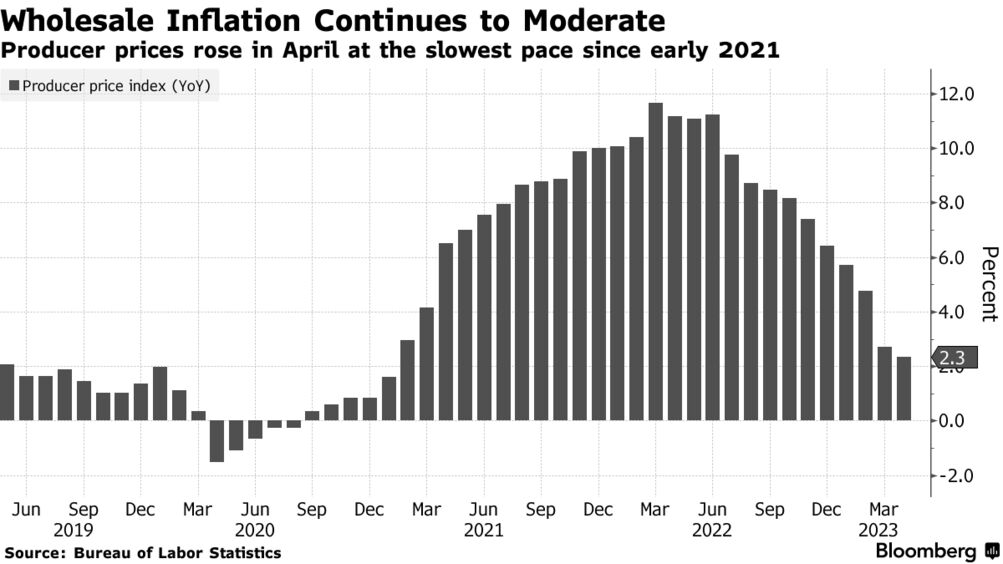

Meanwhile, US producer prices experienced a moderate increase last month, representing the smallest annual rise in producer inflation in over two years. This provides further evidence that inflation pressures are easing.

The final demand producer price index rose 0.2% in the last month. In the 12 months leading to April, the PPI increased by 2.3%, the smallest year-on-year increase since January 2021, following a 2.7% advancement in March.

Joe Manimbo, a senior market analyst at Convera in Washington, said the market is beginning to reassess the possibility of the Fed cutting rates. This is because inflation, while decreasing, remains relatively high.

He added that if rate cuts are removed from the table, the dollar might rise, allowing it to retain its yield advantage for longer.

On Wednesday, investors took profits on gold as optimism over the Federal Reserve cutting interest rates this year dwindled after the US inflation report. The report showed the US Consumer Price Index (CPI) rose 4.9% in April from a year earlier, below the expected 5% increase, causing gold to rise by 0.7% before turning negative.

This data disrupted the momentum building for an 11th straight interest rate hike in June, with most futures tied to the Fed’s rate betting on a pause.

However, gold may struggle in the short term as core inflation remains unchanged from last month and well above the Fed’s target.

Despite this, some analysts predict that gold could attempt to reach record highs due to ongoing economic concerns, such as a potential US debt ceiling default.

Janet Yellen, the US Treasury Secretary, has cautioned that the failure to increase the borrowing cap could result in a default on US payments as early as June 1.