Gold retracement gives a possible long reentry for the Bulls. Rising wedge pattern identified on the 4-hour time frame. Market overview as we approach the Fed meeting next week. Quick Recap Gold Futures pushed through the $1,780 level mentioned in our analysis on December 2nd. The price has retraced from a recent high of $1,822.9 Read More…

Month: December 2022

Equities Decline After Upbeat US ISM Data

The US economy’s strength stoked concerns about the prospect of higher rates. US services industry activity unexpectedly increased in November. The market anticipates the terminal rate to increase to 5.001% in May, up roughly nine basis points from last week. Global equities rose slightly on Tuesday after Monday’s decline as fresh indications of the US Read More…

E-mini Russell 2000 (RTY): Order Block Identified

There is a powerful order block at $1,900 that we are watching closely. Potential long opportunities found on the daily chart. Fisher Transform analysis on the 4-hour chart. Order Block At $1,900 We learned a lot about order blocks from Jipson’s interview; if you haven’t seen it, you can do so here. He withdrew over Read More…

Currency Futures Prices Rise on Improved Risk Sentiment

Investors are growing more optimistic about China’s reopening. US firms created 263,000 jobs in November, well over estimates of 200,000. The Fed will likely increase rates by 50bps at the next meeting. Currency futures prices rose on Monday as the US Dollar failed to gain traction and wallowed at five-month lows. The traders downplayed the Read More…

A Fresh Look At Crude Oil’s Volatile Price Action

Crude Oil (CL) futures fakeout from last week as price rallies back into the Parabolic channel. The Bears have a 1-2-3 reversal and resistance zone to work with. Bulls have an Inverse Head and Shoulders and the Parabolic channel in their favor. Dead Cat Bounce After we saw CL drop below $76.25 last Monday, the Read More…

Precious Metals Pause Rally Ahead of NFP

Data revealed that manufacturing activity in the United States shrank in November. The PCE price index grew 6.0% in the year ending in October after rising 6.3% in September. Precious metals may benefit from Friday’s jobs data meeting or falling short of expectations. After a rough day on Thursday, precious metals pulled back slightly on Read More…

E-mini S&P 500 (ES): Bullish Target at $4,105 Hit

The Bull target for ES at 4,105 has been hit. Market in anticipation of the Feds meeting on December 12. A bull flag pattern has been spotted on the hourly chart. Bull Target Hit From Last Week’s Analysis Last week we mentioned the possibility of ES rallying up to the top of the downward trend Read More…

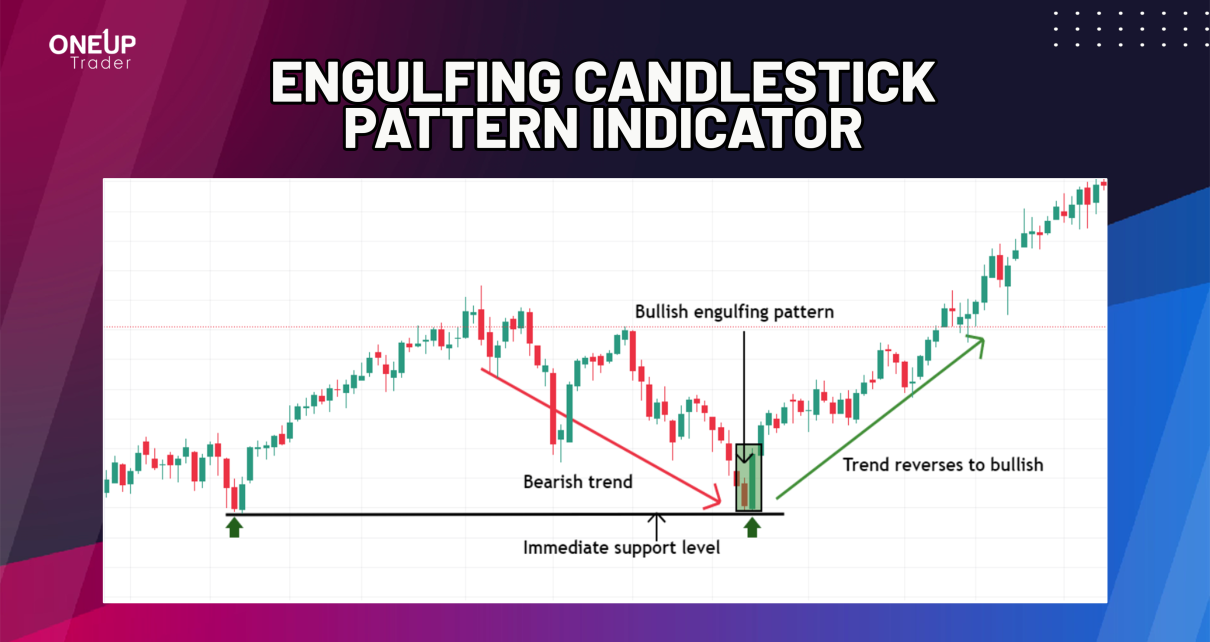

Engulfing Candlestick Pattern

The engulfing candlestick pattern signals potential trend reversals. And since candlesticks patterns are not laggy, you have a higher probability of catching the onset of a trend. Throughout this guide, we’ve discussed how you can identify bullish and bearish engulfing candlestick patterns and how you can use them to trade market reversals. What is the Read More…

Oil Prices Surge on Massive Stockpile Draw

US crude oil stocks fell by about 13 million barrels in the week ending November 25. Oil rose with hope for a revival in demand in China, the biggest consumer of petroleum. The US Dollar declined after Powell’s speech boosted oil prices. On Wednesday, Oil prices rose by more than $2 a barrel due to Read More…

E-mini Nasdaq 100 (NQ) Futures Rally As Powell Eyes Slower Rate Hikes

The double bottom formation was confirmed after Powel’s comments yesterday. A Bullish divergence pattern is spotted on the weekly chart. Momentum is firmly in the bull’s favor. Massive Price Rally in NQ Wall Street jumped on Wednesday after Federal Reserve Chair Jerome Powell said the central bank might scale back the pace of its interest rate hikes Read More…