Introduction Last week, we looked at Crude Oil (CL) Futures, which were testing the support zone between $62.4 and $61. The sideways price action, which was dominating, could be coming to an end as the sellers found the strength to push the price below the level, falling 4.24% on Friday, its biggest drop since June. Read More…

Tag: stock market

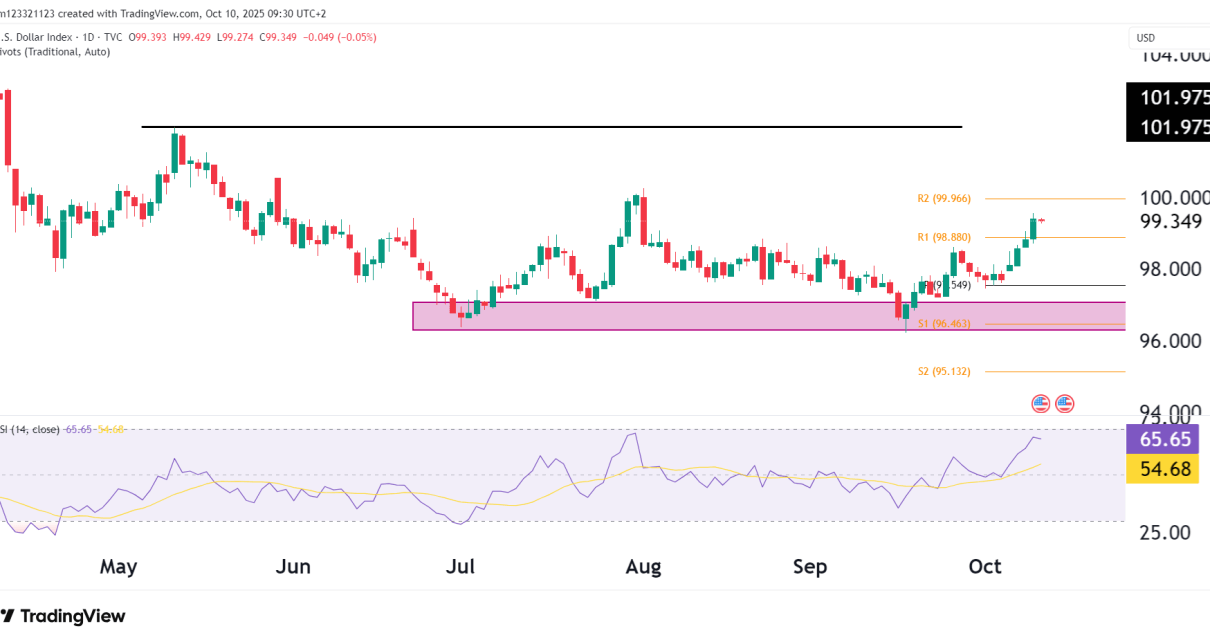

U.S. Dollar Index (DXY) Technical Analysis, 10 October 2025

Introduction The U.S. Dollar Index (DXY) has extended its rally sharply from late-September lows, where price tested a support zone since July. Now hovering near 99.35 after pushing through the R1 pivot at 98.88 and approaching the R2 level at 99.96. The rally is a clean bullish move as price rallied from the support zone, Read More…

Nasdaq-100 Futures (NQ) Technical Analysis, 9 October 2025

Introduction NQ continues to make higher highs and follow the upward-sloping trendline since April. NQ is up 54% since then. Price is above the 50-MA (24,083) and 200-MA (21,876), and the trend remains firmly bullish. There are very few pullbacks on the daily chart, with the biggest being 4.4% leaving very few opportunities for traders Read More…

Florida Consultant Withdraws $16,900 Trading Price Action

Introduction Meet Sali, a 31-year-old consultant from Florida who has built a steady side income through the OneUp Trader funded trader program. Since joining OneUp Trader, Sali has made five separate withdrawals totaling $16,900, all while balancing a professional career with trading. Using a simple yet effective price action strategy, Sali shows how consistency and Read More…

Euro FX Futures (6E) Technical Analysis, 8 October 2025

Introduction 6E failed to hold its recent peak and attempted breakout above 1.18895 on 16 September and has rolled back beneath the 50-day moving average. The drop leaves price vulnerable to a move down to 1.1424, but higher-timeframe support is still intact. The small cluster at 1.165 is something the bulls will try to defend. Read More…

US Equities Extend Rally as Tech and Metals Drive Market Optimism

US equities began the week with the tech and metals sectors leading the rally, pushing the indices higher as the Nasdaq surged beyond the 25,000 mark. The markets are not only betting on short-term strength but on a multi-year growth cycle fueled by automation, AI, and digital infrastructure. Capital flows are increasingly tilted towards innovation Read More…