Global nations continue to maintain a health emergency due to the coronavirus pandemic. However, the economic impact on some of the world’s biggest commodity markets will continue to linger for a long time. In fact, the economic shock due to pandemic would result in the decline of major commodity prices throughout 2020.

Crude Oil and the Possibility of Recovery

Unlike food, metal, or other commodities, the plunge of the crude oil market was the worst. However, after two-third continuous dips, there is a good chance the crude oil prices will gradually start to normalize in the foreseeable future.

The unprecedented downfall of the oil demand, however, will see a reversal. Consequently, the sharp benchmarks went straight to negative levels. Amidst the plunge in oil prices, the Brent crude oil dropped by 70%. Furthermore, the historic production cuts by oil producers and Petroleum Exporting Countries didn’t lift crude oil prices throughout April.

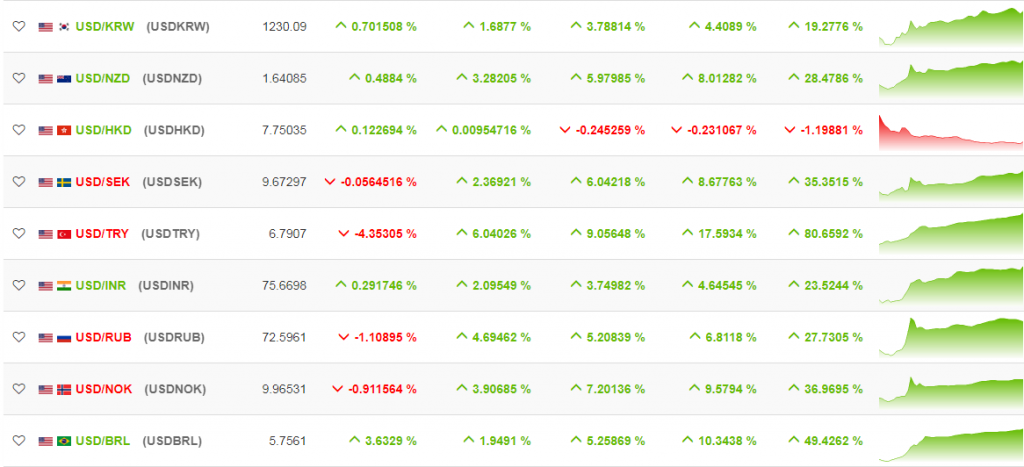

The Indication of FX Forecast

The vast majority of the currencies faired higher on charts despite the continuous plunge of gains. However, earlier growth is now less progressive for USD and EUR:

Central Banks and Court Rulings

When it comes to the QE and ECB, the federal ruling of a German Court dictates that the public-sector buying is partially illegal. As a result, the state of the European debt market hangs in the balance. Conversely, the Bank of England’s policy pertaining to asset purchases and the bank rate is still the same.

The short-term value of the British pound holds. However, if the Brexit trade deal falls apart, the path to recovery from the coronavirus recession would be tumultuous. Surprisingly, the central bank of Norway lowered the interest rate to mere zero. It is one of the reasons kroner is trading comparatively better than others and gaining confidence from pivotal monetary policy.

The Global Outlook of Bonds

Here is an overview outlook of the global bonds:

US – Corporate Bonds

There will be a narrow credit slide for BB-rated and low-grade investment bonds due to the current Fed support that might improve the second half of the economy. However, it is fair to assume that the Fed will not cater to issuers that have high leverage or lack profitability prior to coronavirus pandemic.

Turkey

The economy of turkey will likely contract by the end of 2020 because of the COVID-19 pandemic. Primarily, the overdependence on external financing and forex reserves decline will become decisive factors for the country’s debt sustainability. With an increase in the unemployment rate and uncertain geopolitical elements, maintain a sell position.

India

Currently, there are serious concerns related to the downgraded rating that is affecting GDP growth. Apart from the fiscal deficit and relative GDP debt of the country, the economy can still thwart the negative shocks and review its ratings. Mostly, the value of bonds is opportunistic and remains on hold as the negative high-yield can change the buying position.

Equities: Asian Tech Market and More

Evidently, the outperformance of quality stocks to help equities recover amidst bear market is real. However, the accumulation hints that quality A & H shares will see dips. The complete control over the export or development of military-grade tech seems unrealistic.

That said, Russia, Venezuela, and China are now opting for US tech to develop military aircraft, surveillance tech, and weapons via standard supply chain channels. However, the implementation of more restrictions on technologies such as sensors or semi-conductor machinery may get exemptions.

The current Chinese demand holds at 35% with 144.5 billion USD. After all, semi-conductors are the fifth biggest category after autos, crude oil, and refined oil. As the blame game continues to unravel, the tech sector will experience new vulnerabilities.

The State of Energy Sector

Most of the major gas and oil companies want more visibility and awaiting how the crisis evolves. For instance, Exxon expects the returns to normalize during the first quarter (Q1) of 2021. It is the optimism surrounding the energy sector that would help bridge the dividend gap for companies.

But the decision to keep or cut back on dividends will be based on whether the crisis would prolong or halt in the coming months. Portfolio managers, for instance, highlight the fact that oil companies are under immense pressure to make renewable energy investments during uncertain times. However, reliable and attractive dividends might be enough motivation to hold gas and oil stocks.

Bottom Line

The dwindling demand destruction shows a pattern of oil crude prices and other commodities in the upcoming months. Nonetheless, the fall highlights severe global disruptions as the lockdowns and COVID-19 pandemic cripple the global economy. As much as the economic parameters predict bad outcomes, the return of swift economic growth is still possible.