Recap The last time we looked at T-bond futures was at the beginning of August when we expected price to move lower into a support zone. This happened last week as ZB touched last year’s lows. Let’s see where we expect price to go from here after the support zone successfully held. Technical analysis As Read More…

Tag: bonds

A fresh look at T-bond futures (ZB)

Introduction: Based on the daily chart, this technical analysis of T-Bond Futures (ZB) will examine the recent price movement, key technical indicators, and potential trading opportunities. Throughout the year, ZB has experienced relatively flat price action, lacking a clear trend. The 50-day moving average sloping downward and the price trading below it suggests the presence Read More…

T-Bond futures (ZB) break down, fear spreads

Introduction There are a mixed bunch of factors playing into ZB’s price action, which we will look at below. Bulls and bears are fighting, and we can’t be sure which will come out on top. Let’s take a look at some of the technicals that might give us an idea of what looks to be Read More…

Bullish opportunity presents itself in T-bond futures (ZB)

A fresh look at the technicals Ascending Triangle: There is an ascending triangle on the daily chart. This tells us that the market is forming a bullish bias. Price is currently testing the diagonal support line at 127’27. Capitulation Candle: There was a capitulation with a high volume spike at the low I pointed to on the Read More…

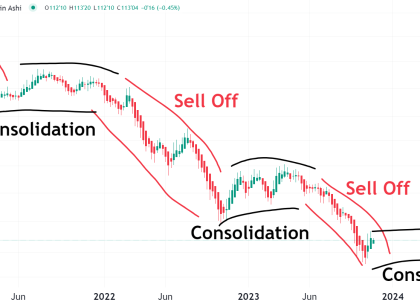

T-Bond Futures (ZB) bears take control

Introduction ZB futures have been in a steady downtrend since 2020 as investors buy more and more bonds. The sentiment remains that more buying will continue meaning we can expect yields to continue to drop, and that provides us with some useful opportunities we can take advantage of. Technical analysis There is a resistance zone Read More…

Rising Oil Prices – Here’s What To Look Out For

Over the last few months, rising oil prices have many market participants’ attention. The chart below shows the price of oil, which peaked at the end of October 2021 and then fell about 25%. It bottomed in early December 2021 and hasn’t looked back. Oil broke through the Oct 2021 high of $85 a barrel Read More…