Equities surged on Tuesday as US inflation data for October came in lower than expected. The data sparked investor confidence at the end of an era of interest rate hikes and the possibility of imminent reductions in borrowing costs. US inflation (Source: Bureau of Labor Statistics) Data revealed that US consumer prices remained steady in Read More…

Analysis

Crude Oil Futures (CL) Technical Analysis: A Short-Term View

Key Price Levels to Watch: Technical Indicators Overview: Fibonacci Retracements: Potential Market Scenarios: Conclusion As we wrap up our technical analysis of Crude Oil Futures, it’s clear that the market is at a crossroads, with key levels at $74.91, $95.03, and $68.07, offering guidance on potential future movements. Remember, the true skill in futures trading Read More…

Equities Slip as Investors Await Pivotal Inflation Reading

On Monday, US equities closed slightly lower as investors anxiously awaited a crucial inflation reading that could influence the duration of high interest rates by the US Federal Reserve. Following a strong rally on Friday, attention shifted on Monday to the Consumer Price Index (CPI) data scheduled for release on Tuesday morning. US CPI (Source: Read More…

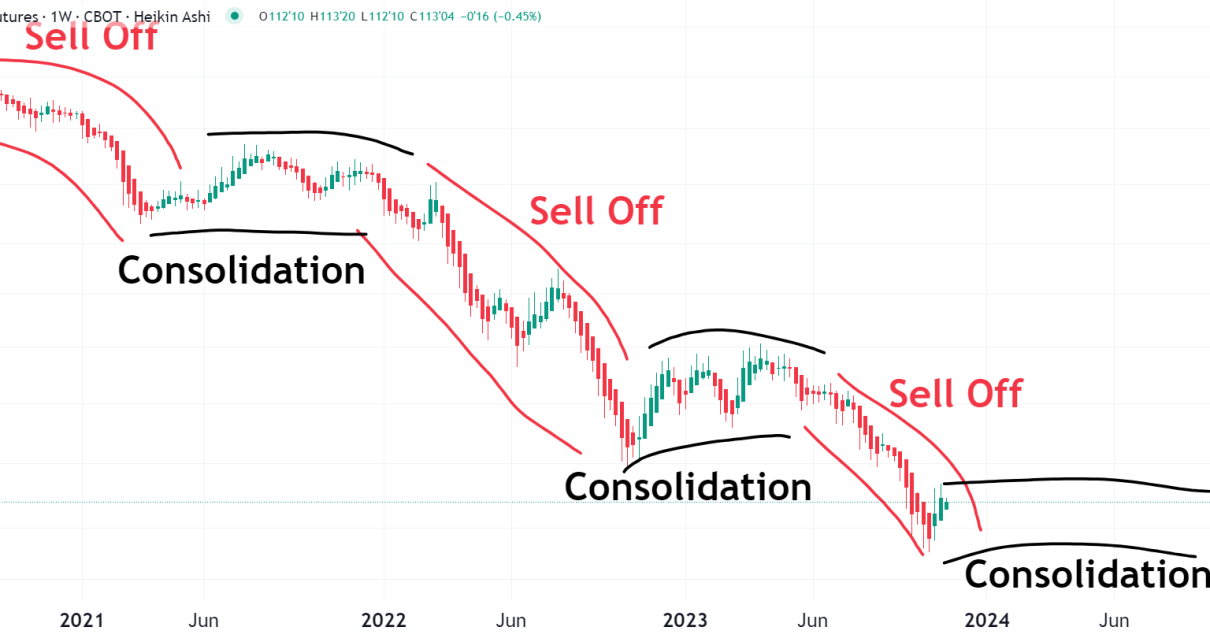

Is The Bond Buying Bonanza Over?

Intro The bond-buying has hit a roadblock for the moment as ZB shows signs of a reversal. On the ZB futures chart, we look at this inversely as bond buying means the chart goes down because yields get less. So for this article, when ‘bullish’ is made as a reference it indicates the chart is Read More…

Currency Futures Mixed as Investors Assess Powell’s Remarks

Currency futures closed Friday mixed as investors assessed remarks from Fed Chair Jerome Powell. The euro fell, while the yen weakened against the dollar. Powell indicated the possibility of another rate hike if inflation persists above the target. The yen held near a one-year low against the dollar, and investors remained cautious about a potential Read More…

Gold Futures (GC): Technical Outlook

Introduction Not much has changed since our previous analysis in GC, as sentiment remains bullish in the medium to long term. There is a small pullback at the moment, which is looking close to providing a long opportunity in the yellow metal though. With the increasing uneasiness in the Middle East, we could see gold Read More…