Introduction

Crude oil could be breaking out of a multi-year downtrend and on its way to triple digits once more. This is a big speculation but if you look at the chart below, you will see why it could be a possibility. At least, the support is very strong and even if price does not fly, there are high probability entries at the support zone $70 and unlikely price will break it to the downside for now.

Trade Opportunities

Long Position

- Entry: Consider entering a long position if the price closes above the descending trendline, confirming a potential trend reversal.

- Target: The initial target could be around $90.00, a previous support turned resistance level, followed by $100.00 if the bullish momentum continues.

- Stop-Loss: Place a stop-loss below the recent support zone, around $75.00, to manage risk or to be extra safe, below the support zone.

Short Position

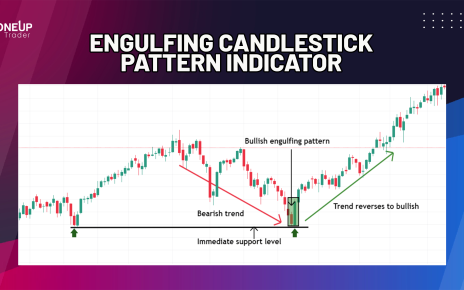

- Entry: A short position could be considered if the price fails to close above the descending trendline and shows signs of bearish reversal on shorter time frames in the form of candlestick patterns or chart patterns.

- Target: The target for a short position could be the lower end of the support zone at $70.00 but not lower than that.

- Stop-Loss: Place a stop-loss above the recent high, around $83.00, to limit potential losses.