- On Thursday, Japanese Yen futures dropped to 0.007780 as the Yen faced renewed pressure amid global yields rise.

- Markets are now waiting for central bank policymakers, including Fed Chair Powell, to make comments that could trigger further gains.

- Bulls anticipate a possible retest of the multi-year lows surpassed earlier this week around 0.007735.

As traders viewed Wednesday’s yen rally as nothing more than a dead cat/bear market rally, the Japanese Yen futures (6J) declined to 0.7780 on Thursday.

At current levels around 0.007790, the 6J is trading around 0.57% lower on the day. The Yen is gaining ground on the Eurozone recovery and US bond yields ahead of ECB and Fed comments tonight by their respective central bankers.

In his speech to the G7 meeting, Japan’s finance minister said little to support the battered yen, reiterating that the Yen’s recent weakness is undesirable and stability is crucial, but without directly signaling an intention to intervene.

An overall positive equity market sentiment weakened the safe-haven Japanese yen, which continued to fall after the Bank of Japan intervened to dampen the rise in Japanese 10-year bond yields. However, a dovish Fed expectation helped traders take advantage of the positive recovery in US Treasury yields.

The downside potential for Japanese Yen futures (6J) is limited since the Yen’s recent decline has sparked speculation that officials will react. However, investors were not interested in that either, preferring to watch an IMF event later in the US session before Jerome Powell spoke.

Meanwhile, the BOJ purchased JGBs to protect the upper end of its -0.25% to 0.25% target range, which means that they have added stimulus, further weakening the Yen.

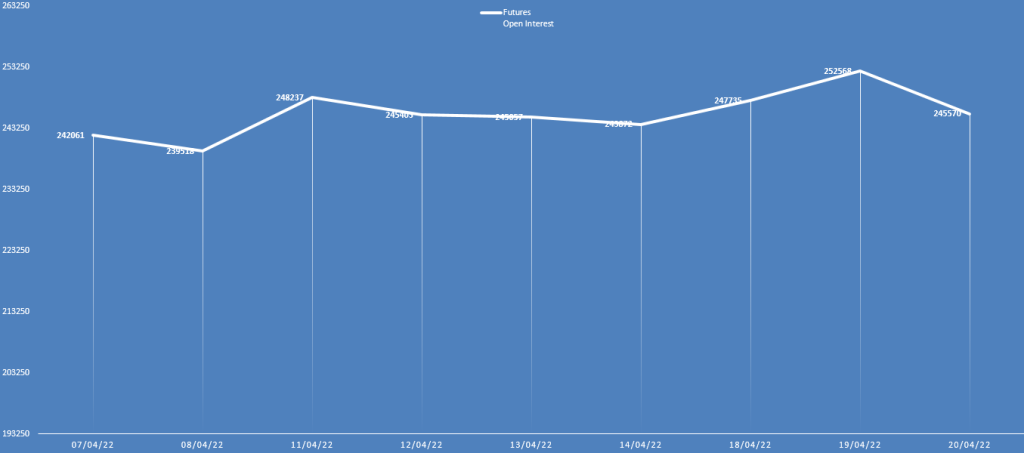

Japanese Yen futures (6J) daily open interest

The Yen futures rose yesterday but the daily open interest significantly dropped. This shows that the bearish pressure still remains intact. Only the sellers booked profit while no new buyers entered the market.

Japanese Yen (6J) futures technical analysis: Bulls lack conviction

The price for Japanese Yen futures remains capped by the 20-period SMA (green colored) on the 4-hour chart. Although the 6J attempted to recover from the two-decade lows of 0.007735, the bulls lack follow-through momentum to accelerate further. Moreover, the volume bars also show no clear signs of bullish reversal. Hence, the upside seems shallow and may provide a selling opportunity to the traders.

However, if the price breaks above the 20-period SMA and sustains the rally, we may see a further rise towards 0.007850 ahead of 0.007900.