- Data revealed that manufacturing activity in the United States shrank in November.

- The PCE price index grew 6.0% in the year ending in October after rising 6.3% in September.

- Precious metals may benefit from Friday’s jobs data meeting or falling short of expectations.

After a rough day on Thursday, precious metals pulled back slightly on Friday as investors await key economic data. This follows a significant rally on hints from the US Federal Reserve that it might decrease the rate at which it hikes interest rates.

After Fed Chair Jerome Powell stated the time had come to pause rate increases, the US dollar index dropped to its lowest point since August, and Treasury yields tumbled. In addition, he mentioned the long-term economic adjustment to rising borrowing rates, the gradual reduction in inflation, and the ongoing labor shortage in the United States.

Precious metal investors applauded Thursday’s indications of easing inflation in the United States. Data also revealed that manufacturing activity in the United States shrank in November for the first time in 2-1/2 years as higher borrowing costs weighed on demand.

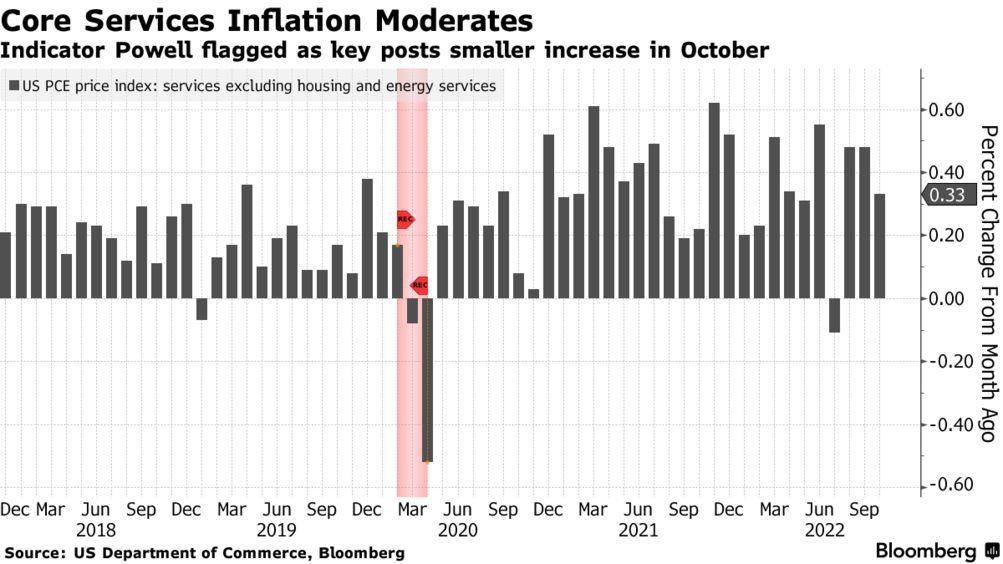

Investors perceived lowering inflation as supporting the Fed chair’s statement that rate increases may slow. The personal consumption expenditures (PCE) price index grew 6.0% in the year ending in October after rising 6.3% in September.

Precious metals may benefit from Friday’s jobs data meeting or falling short of expectations since it would support the Fed’s decision to ease rate hikes.

On Thursday, gold prices increased by 2% to above the pivotal price level of $1,800 an ounce as the dollar fell on expectations that interest rates will gradually increase by the Federal Reserve, indicating that U.S. inflation is slowing.

The dovish stance of (Fed Chair Jerome Powell) is boosting the commodity markets, and the U.S. dollar index has begun to back off, according to Jim Wyckoff, the senior analyst at Kitco Metals. “We’ve built a price uptrend on the daily chart, which attracted technical-based purchasing,” he added.

According to traders, the likelihood of the Fed’s 50bps interest rate increase on December 14 is 91%. Rising US interest rates significantly impact the price of gold because they raise the opportunity cost of owning non-yielding metal.

In a report, analysts at JP Morgan noted that with the Fed on pause, declining U.S. real rates are driving their bullish baseline expectation for Prices for gold and silver in the second half of 2023.