- The war between Russia and Ukraine escalated on Thursday.

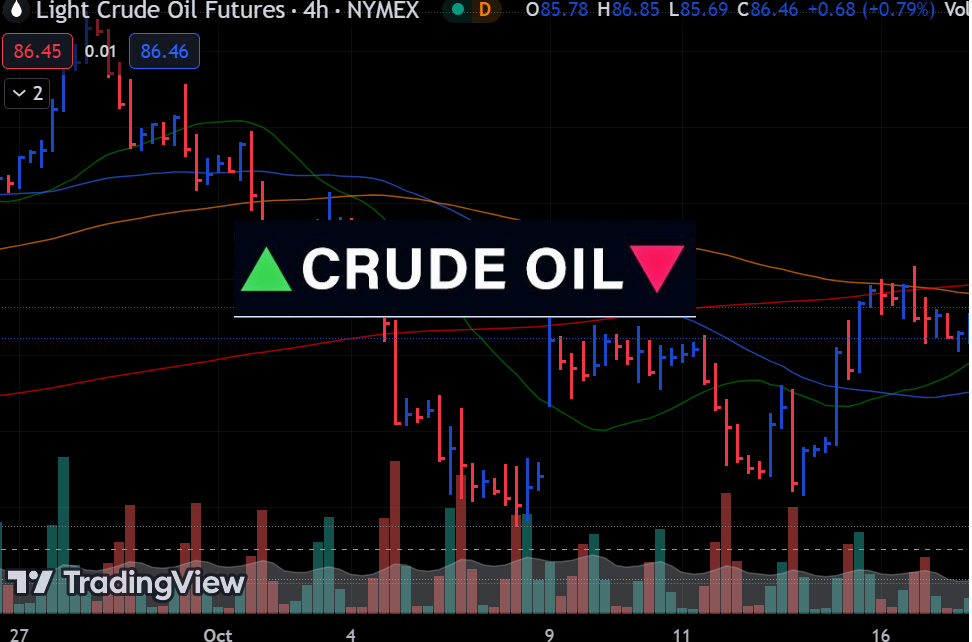

- Oil prices dropped on Wednesday after data revealed that US crude inventories increased more than expected.

- Data from last week revealed that inflation increased in line with economists’ forecasts.

Oil prices rebounded on Thursday amid supply concerns as the war between Russia and Ukraine escalated. In the previous session, oil ended down as US crude inventories came in higher than expected.

The war between Russia and Ukraine escalated on Thursday as the two countries exchanged missiles. This came after Ukraine used US missiles to attack Russia. Russia responded by sending back more powerful missiles. At the same time, it noted that Ukraine was using Western weapons in the war, which could escalate tensions.

Oil prices rose because Russia is a major producer. Any targeted attack on Russian oil would disrupt supply and tighten the market. At the same time, investors are keeping an eye on the Middle East conflict, with tensions between Israel and Iran increasing.

US crude inventories (Source: Bloomberg)

Meanwhile, in the previous session, oil prices dropped after data revealed that US crude inventories increased more than expected, indicating weak demand. At the same time, there is a chance that OPEC+ will keep delaying production increases due to a weak demand outlook in China. Therefore, production cuts will likely continue to support oil prices longer than expected.

Elsewhere, investors are watching developments in US politics and incoming economic data for more clues on Fed policy.

Last week, the dollar soared to new peaks amid optimism about looming policy changes in the US. As a result, oil became more expensive for foreign buyers. Markets expect robust growth and higher inflation under the Trump administration. The robust growth might temporarily increase oil demand. However, as inflation spikes, the US central bank will be forced to keep borrowing costs high to cool the economy.

Data from last week revealed that inflation increased in line with economists’ forecasts. As a result, markets were more convinced that the Fed would lower borrowing costs in December. However, Powell noted that there was no hurry to cut rates, which lowered rate-cut expectations.

Nevertheless, the US will release more economic data before the December meeting, which might change the Fed’s outlook on policy. Upbeat data will show a resilient economy that still needs high rates to control demand. Therefore, bets would fall. On the other hand, downbeat data would solidify bets for a cut in December.