- Data on Wednesday revealed that US gasoline inventories increased by 3.3 million barrels.

- The US core PCE price index increased by 0.3%, meeting forecasts.

- On Tuesday, oil prices plunged after Israel and Hezbollah agreed on a ceasefire.

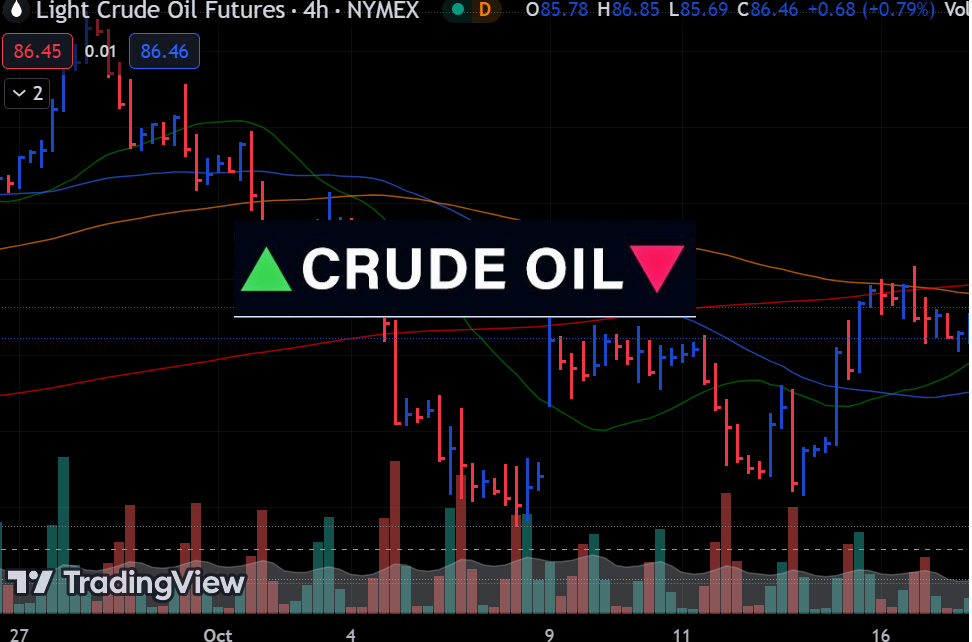

Oil prices held flat on Thursday as the US observed the Thanksgiving holiday. Moreover, US crude and gasoline inventories data in the previous session revealed a mixed picture of demand.

Data on Wednesday revealed that US gasoline inventories increased by 3.3 million barrels. Meanwhile, economists had expected a 46,000 barrel draw. At the same time, crude inventories dropped by 1.8 million barrels, well above expectations of a 605,000-barrel draw. The mixed report left traders unsure whether to buy or sell. As a result, oil prices held steady.

Elsewhere, US economic data increased the likelihood of a Fed rate cut in December. However, the outlook for 2025 changed, with experts predicting fewer rate cuts. As a result, investors expect the Fed to pause in January and March.

According to data, the US Core PCE price index increased by 0.3%, meeting forecasts. Although it aligned with expectations, it showed that the downtrend in inflation had paused, reducing expectations for rate cuts next year. High borrowing costs hurt businesses and consumers, reducing oil demand.

Meanwhile, another report showed that the economy expanded by 2.8%, in line with estimates. Economic growth has also stalled for two quarters. Finally, data showed that unemployment claims eased slightly, indicating a resilient labor market.

More employment figures next week will show the health of the labor market, giving clues on future Fed moves. The NFP report might also alter bets for a December rate cut.

On supply, sources said that the OPEC+ group might decide to delay an output increase that was meant to start in January. The major oil producers have kept delaying output increases due to weak consumption which has weighed on prices. At the same time, increased supply from outside the group has loosened the market, making it difficult for OPEC+ to achieve its objective of raising prices.

On Tuesday, oil prices plunged after Israel and Hezbollah agreed on a ceasefire that started on Wednesday. Reduced conflict in the region lowers the risk of escalation, removing the premium on oil prices. However, geopolitical tensions will continue to support prices in other areas like Russia, which is a major oil producer.