- The US released data showing a 5.4 million barrel rise in crude inventories.

- A rally in the US dollar weakened demand for oil.

- Support for oil came from the looming threat to Iranian oil.

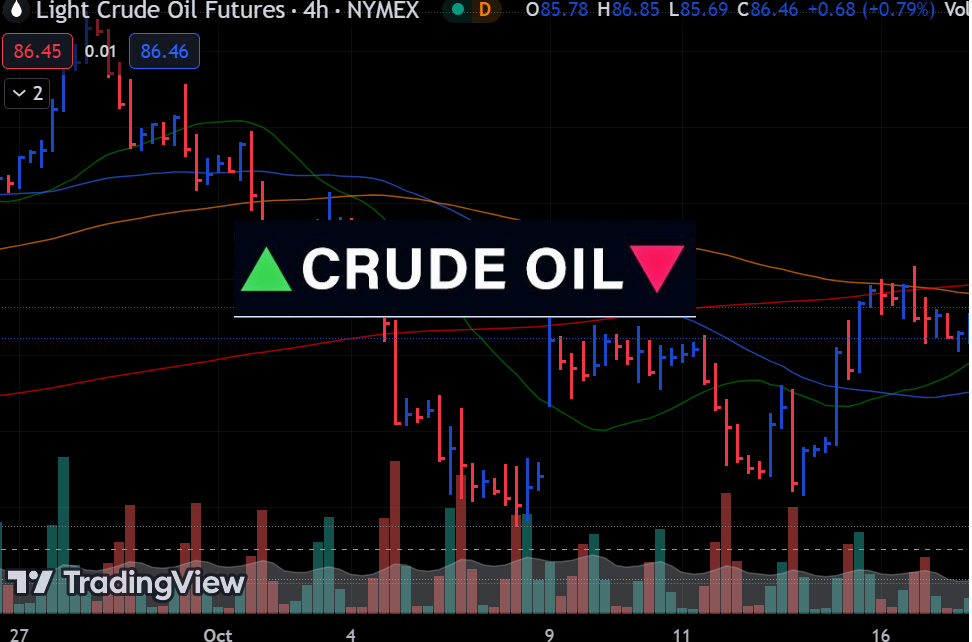

Fears of Iranian oil disruptions and Hurricane Milton in the US boosted oil prices on Thursday. In the previous session, prices fell due to a bigger-than-expected increase in US crude oil inventories.

Oil eased on Wednesday after the US released data showing a 5.4 million barrel rise in crude inventories. Meanwhile, economists had predicted a smaller 2 million barrel increase. The data revealed weak demand for oil in the previous week. However, there were some pockets of solid demand, with larger-than-expected draws in distillates and gasoline stocks.

Furthermore, a rally in the US dollar weakened demand for oil, making it more expensive for foreign buyers. The greenback has recently rallied as market participants reprice Fed rate cut expectations. Notably, the US released a blockbuster jobs report on Friday last week. The economy added a bigger-than-expected 254,000 jobs, with unemployment easing to 4.1%. Consequently, markets lowered the likelihood of another super-sized rate cut in November. Instead, the possibility of a 25-bps rate cut rose to over 80%.

Initially, investors had priced an aggressive rate-cutting cycle that would quickly boost the economy and fuel demand. However, the new outlook supports gradual easing. This is bearish for oil in the near term. However, it will spur economic growth and boost oil demand in the long run.

Further downward pressure for oil came from China’s demand concerns. Investors expected China’s top officials to announce more fiscal support measures to boost growth. However, they maintained that they were confident the economy would achieve its targets by the end of the year. Markets were disappointed to hear this.

Experts have noted that China’s economy might need more support to recover sustainably. Weakness in the largest oil consumer hurts the demand outlook. As a result, the Energy and Information Administration downgraded its 2025 demand outlook. Any future stimulus will likely support oil.

Brent futures (Source: ICE)

Meanwhile, support for oil came from the looming threat to Iranian oil. Iran’s attack on Israel boosted oil as it caused fears of retaliation that could tighten the oil market. However, on Tuesday, oil dropped by 4% due to the likelihood of an Israel-Hezbollah ceasefire.

Elsewhere, the US is dealing with Hurricane Milton in Florida, which has put a premium on oil and oil products.