- The United States manufacturing sector recovered from a three-year low.

- US construction spending rose more than anticipated in March.

- JPMorgan Chase & Co. agreed to purchase most of First Republic Bank’s assets.

Wall Street equities ended slightly down, and Treasury yields rose as investors reviewed Monday’s data. They were awaiting Wednesday’s Fed’s interest rate decision and quarterly earnings reports.

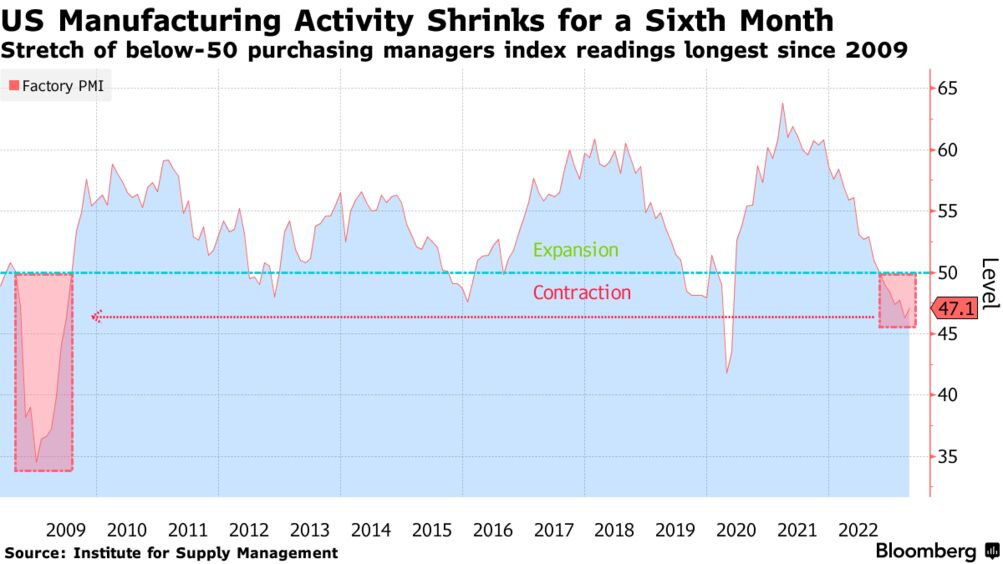

Data showed that the US manufacturing sector recovered from a three-year low in April as new orders and employment increased. However, the sector’s activity remained weak due to increased borrowing costs.

Despite the decline in manufacturing activity and consumer demand reported, inflation pressures increased last month.

Additionally, investment in non-residential structures helped US construction spending rise in March. However, single-family homebuilding remained weak.

According to Matt Stucky of Northwestern Mutual Wealth Management Co., the figures increased the likelihood that interest rates will rise in June. They also confirmed long-held views that the Fed would raise rates by 25 basis points in May.

May is now a done deal, and June is the next. Given the data’s strength, the Fed will likely maintain its restrictive stance.

The higher the Fed needs to raise interest rates, and the longer they have to keep them there, the higher the chance of recession.

Support came from JPMorgan Chase & Co.’s agreement to purchase most of First Republic Bank’s assets. The deal came after regulators seized the struggling institution, the third significant US bank failure in two months.

Some international markets were closed on May 1 for a holiday. At the same time, investors in the United States were preparing for data coming later in the week. The US nonfarm payrolls report for April will come out on Friday. Additionally, earnings reports like Apple Inc.’s are due on Thursday.

China’s weak economic data was also in the spotlight. The manufacturing purchasing managers’ index (PMI) for the world’s second-largest economy fell to 49.2 from 51.9 in March. A score below fifty denotes a contraction.

Elsewhere, Canada’s main stock index marginally declined on Monday. Prices fell amid declines in energy, rate-sensitive real estate, and technology firms. The energy sector drove down the main index in Toronto. Energy fell 1.3% as investors’ worries about a recession persisted.

There was little to report in Europe before the ECB meeting as markets were closed for May Day.