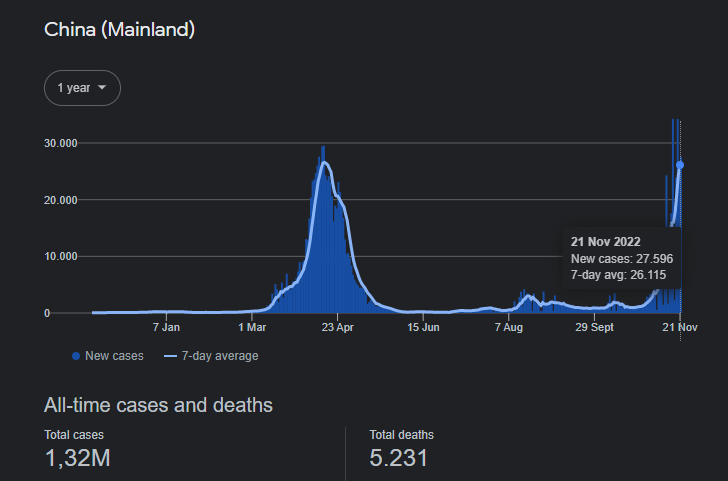

- China’s Covid cases continue to plague markets as investors fear the return of the zero-COVID policy.

- The Organization for Economic Cooperation and Development will soon release its most recent economic outlook.

- Goldman Sachs warned that the global equities bear market is not yet over.

Equities dropped on concerns that China would resume stricter COVID-19 control measures after claiming to be facing the pandemic’s most challenging test yet. As Beijing closed parks and museums on Tuesday, a statewide surge in COVID-19 cases in China was again the topic of conversation for weary global markets.

Analysts are revising their growth projections for the second-largest economy in the world just as China began to change its zero-COVID policy. Beijing announced on Monday it would close businesses and schools in severely affected areas and tighten entry regulations as infection rates continued to rise.

The Organization for Economic Cooperation and Development will release its most recent economic outlook on Tuesday. Global markets are pricing in a slower-than-expected Fed pivot, and inflation shows little signs of easing. The Paris-based policy forum had issued a warning in September, expressing particular pessimism on the prospects for Europe. They said the energy and inflation problems risk sending major economies into recession.

Goldman Sachs warned that the global equities bear market is not yet over since the markets have not yet experienced a low point in the momentum of weakening global growth, a peak in interest rates, or a reduction in valuations to reflect a probable recession.

There were few shocks in the speeches made by Fed speakers on Monday; Cleveland Fed President Loretta Mester said the central bank could turn to smaller increments of interest rate increases starting next month.

Equities in the energy sector dropped significantly on Monday, as oil prices plunged more than 5% in response to news that Saudi Arabia and other OPEC oil producers were considering raising their supply. However, the sector reversed its decline when Saudi Arabia dismissed the claims on Tuesday.

Investors are now waiting for the Fed’s November meeting minutes on Wednesday as equities continued declining from the previous week when many Federal Reserve officials reaffirmed the central bank’s commitment to raising rates until inflation was under control. With rates projected to peak in June, traders are overwhelmingly banking on a 50-basis point increase at the December meeting.