Weekly Chart Starting with the weekly chart, the E-Mini Russell 2000 Index Futures are oscillating within a defined trading range between approximately $1964.5 and $2000, with the ATH at $2463.7. The index is currently testing the upper boundary of this range. A convincing breakout above the range could signal a strong bullish sentiment, potentially targeting Read More…

Tag: gold futures (GC)

Gold Hits One-Month Low on Surging Inflation

On Thursday, gold dropped to a one-month low as the dollar rose due to hotter-than-expected inflation data. Moreover, hawkish remarks from Fed officials raised concerns that higher interest rates might continue beyond March. The dollar index rose after US consumer prices rose more than anticipated in December because it potentially delays an anticipated US rate Read More…

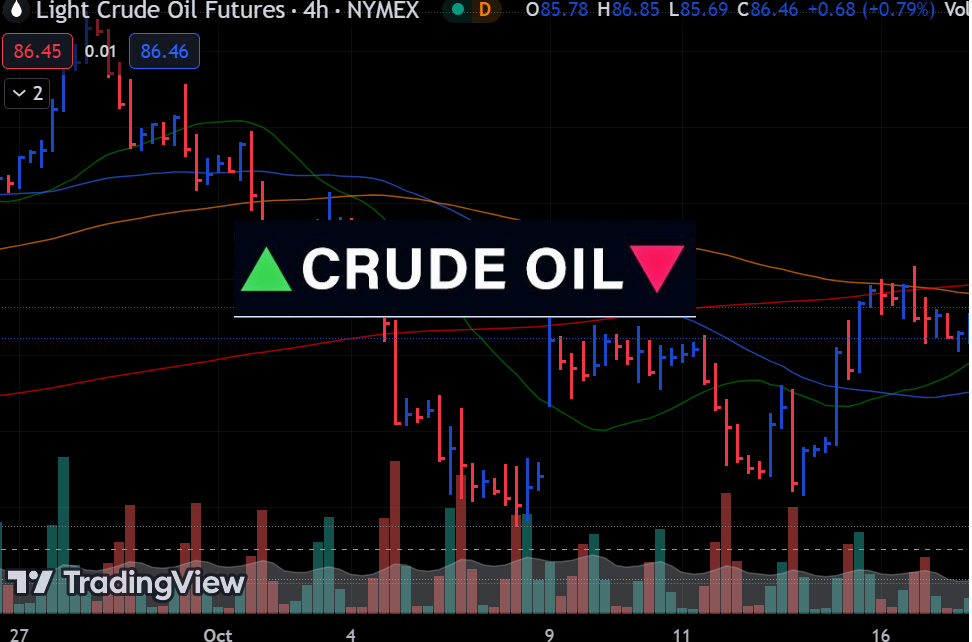

CL Futures at POC – What’s Next for Oil?

Weekly Chart The weekly chart reveals a battle at a critical level for crude oil futures. A well-defined support zone at $71.50-$72.00 comes into focus, clearly marked by previous consolidation and the volume profile ‘point of control.’ This level represents a pivotal battleground between bulls and bears because it tells us that this is the Read More…

Gold Futures (GC) multi-timeframe analysis

The weekly chart shows a triple-top reversal pattern forming, with resistance around $2088. This is a pivotal zone – if price can break out above $2088 decisively, it would invalidate the bearish pattern and imply an upside breakout. However, failure to break resistance could confirm the pattern and precede a downward move. The weekly RSI Read More…

Gold Halts Decline, Gears Up for US Non-Farm Payrolls

On Thursday, gold stabilized after a four-session decline as investors prepared for the upcoming US non-farm payroll data. This report could impact the Federal Reserve’s interest-rate decisions. Jim Wyckoff, senior analyst at Kitco Metals, mentioned the need for a fresh spark in the gold market to start a rally. According to Wyckoff, stronger jobs data Read More…

Gold Futures (GC) approaches ATH again

After gold made an all-time high a few weeks ago, the yellow metal sold off, and the chart turned bearish very quickly. The bulls will be happy to see that the selling pressure has softened and a new rally has begun. GC is now getting very close to the previous all-time high, where we saw Read More…