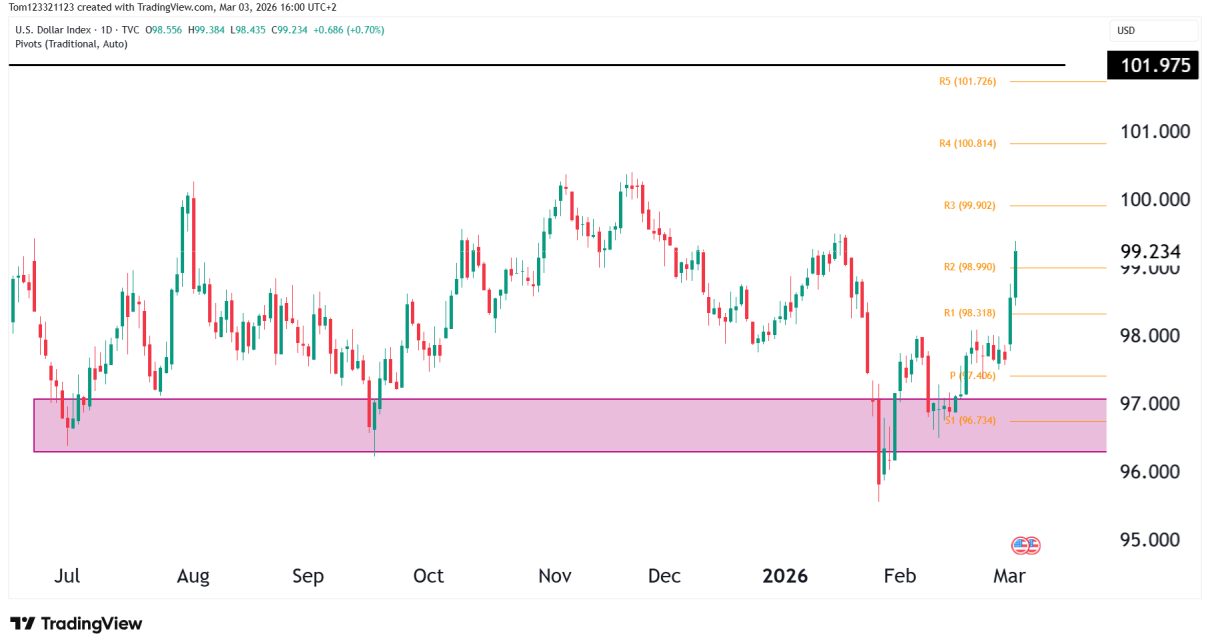

Recap From Yesterday In yesterday’s DXY technical analysis, we highlighted: Today’s price action confirms the bounce is gaining traction. What’s Changed Since Yesterday? Strong Impulsive Move Higher The momentum is accelerating as the conflict in the Middle East continues to escalate. From here, the next most obvious level that comes into focus is the 100 Read More…

Tag: Future Trading Tips

Crude Oil (CL) Technical Analysis – Follow-Up After Breakout

Quick Recap From Yesterday In yesterday’s crude oil technical analysis, we saw a big jump in the price after the weekend’s developments in Iran. Here is a snapshot: The candle from yesterday also closed firmly green after the gap up. After the close, price opened lower but still in the range of the previous candle Read More…

24-Year Old Freelancer Withdraws $27,000 Trading Bond Futures

Introduction A 24-year-old trader from Beverly, Massachusetts, has withdrawn $27,000 in just 25 days across 3 funded accounts with OneUp Trader. Trading primarily through a single $50K account and copying them across two other funded accounts, Jack focused on quick scalps in the 10-Year Note (ZN) and 30-Year Bond (ZB) futures markets using the Jigsaw Read More…

Crude Oil (CL) Technical Analysis – Middle East Turmoil At Forefront

Introduction After a weekend full of major turmoil in the Middle East, Crude Oil (CL) has exploded higher, rallying 12.54% in early Monday trade. Any further developments of the crisis will be closely watched by investors, and all traders should be wary of the volatile swings we are likely to see in the market this Read More…

Gold Futures (GC) Technical Analysis – Follow Up

Introduction In the February 3 analysis, gold had a very big single-day sell-off of 13% after the price was hitting new highs consistently. The analysis we did was to see if there was a higher probability of the market continuing to fall or finding a base and slowly forming a recovery. Since then, the bulls have Read More…

US Interest Futures: Record High Open Interest Amid Policy Uncertainty

Open interest in US interest futures hit an all-time high in February as investors shifted their positions amid concerns about monetary policy, tariffs, and the economy. The CME Group, which runs the world’s largest derivatives market, said that open interest (OI) in its US Treasury futures and options reached an all-time high of 36,328,151 contracts Read More…