BoJ intends to maintain its ultra-loose monetary policy. BoJ will not intervene to stop the yen’s recent sharp declines. The Federal Reserve may continue to raise rates. The Japanese Yen (6J) futures continue to lose ground as one of the Bank of Japan’s board members stated that the central bank must continue its massive monetary Read More…

Tag: Future Trading Strategies

Poor US Economic Outlook Could Favor Gold

US PMI shows a significant decline in business activity in July. The US economy shrank by 0.6% in Q2, showing signs of a looming recession. Gold futures prices could fall further if Powell is hawkish during the Jackson Hole meeting. The latest Flash US Composite PMI from S&P Global is not encouraging for the American Read More…

Crude Oil Prices Rise on Tight Supply Concerns

OPEC+ may reduce output to support oil prices. Iran’s nuclear program deal is at a standstill. Oil prices increase after a drop in US crude oil inventories. The possibility of output reduction, the partial suspension of a US refinery, and growing supply fears due to delays in Russian exports drove up crude oil (CL) futures Read More…

E-mini Nasdaq-100 (NQ) Futures Suffer amid Poor Business Activity in the US

Investors following market patterns are bullish. Investors with access to inflation and earnings data are bearish. Overall market sentiment is bearish on renewed recession worries. Investors following market patterns are becoming more optimistic about the U.S. stock market’s recovery, raising expectations for E-mini Nasdaq 100 (NQ) in the second half of 2022. Stronger-than-expected corporate earnings Read More…

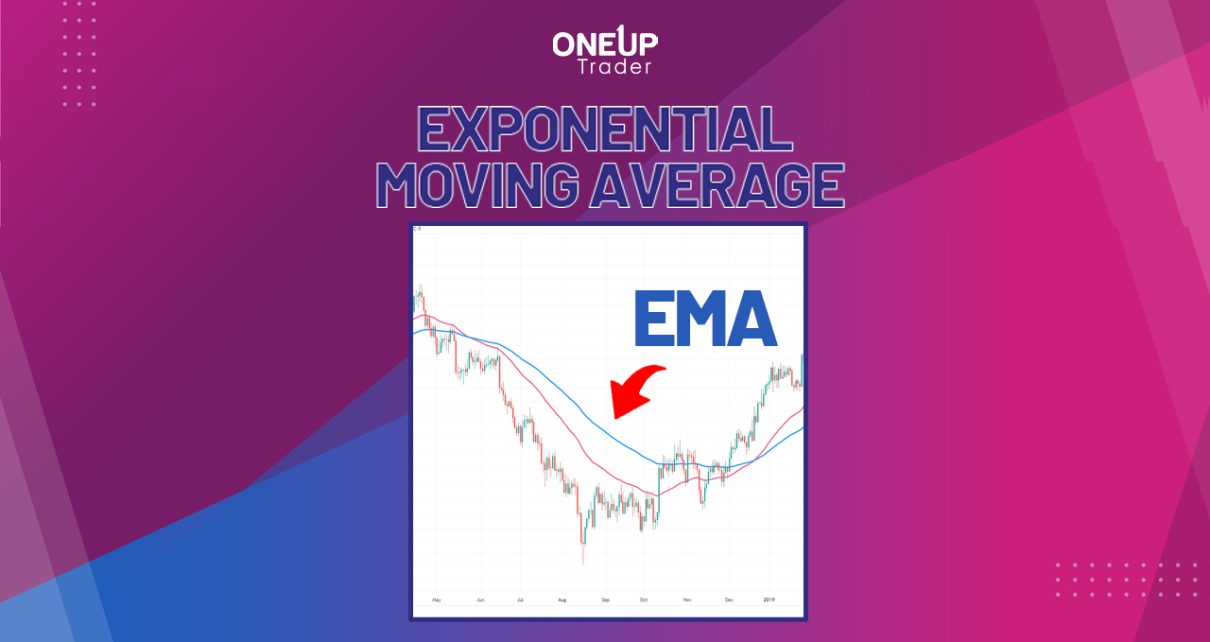

Exponential Moving Average: What is the EMA Indicator?

Moving averages (MAs) are among the most popular technical trading indicators. Their popularity majorly stems from their simplicity and versatility – they are easy to calculate and use; can be used to show both a price action’s trend and strength. Thanks to their popularity, several variations of the moving average exist. This guide will discuss Read More…

The Canadian Dollar struggling amid Falling Commodity Prices

BoC might raise rates by 50bps in September. Canada’s inflation is showing signs of peaking. Falling commodity prices are hurting Canada’s economy. The Canadian dollar remains under pressure amid a stronger greenback. This year, the BoC has already increased rates four times. To combat four decades of excessive inflation, it most recently raised the benchmark Read More…