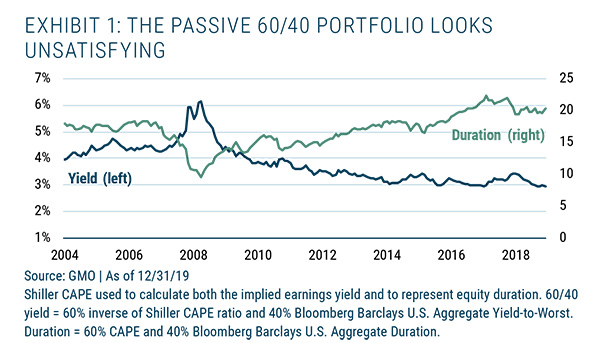

A swift slide in treasury revenues contradicts the world’s popular 60-40 investment schemes utilized around the globe. The old investment style of mixing investment assets by following the 60% stocks and 40% bonds-formula has hit a big resistance. Investors have started using this investment scheme since the 1950s when the modern portfolio theory exploded.

The popular investment strategy recently yielded one of the greatest risk-adjusted returns for the last thirty years outperforming only debt. However, since the treasury yield is currently nearing a zero figure, and will potentially maintain that level for years to come, it’s doubtful that those gains would exist.

Portfolio Managers Seeks Alternatives To 60/40 Asset Mix

The present situation is not the first time the 60/40 investment assets experienced scrutiny. Frequently, an objective of riveting after stock prices rise can short-change investors. However, the strategy-inclined investors still managed to make a positive return because of the 2020 volatile market. The current concentration is more on the opposite side of the mix as yields in the largest debt market around the globe fall to fresh lows.

This makes it less likely for bonds to rise and serve as a good hedge against stock portfolios with falling prices. Because of this, investment managers like JPMorgan Asset Management and U.S. Bank Wealth Management seeks alternative securities that are more likely to rally instead of the Treasuries.

Bill Merz from Minneapolis and the head of U.S. Bank Wealth Management fixed-income research who manages 180 billion dollars said they’re tempted by the current situation use any asset shows positive yield. Investors around the globe are forced by the present scenario to migrate out of riskier assets.

Demands For The Review Of The 60/40 Investment Portfolio

The demand for the 60/40 investment portfolios to be scrapped restarted in August when the U.S.-China trade tensions worsened fears of a worldwide economic meltdown. Bank of America Corp. and Morgan Stanley towards the end of 2019 gave a warning about moderate returns late last year. However, anticipations that the Fed will in the end cap yields for a few Treasury maturities have further provided support to their earlier arguments.

According to Jan Loeys, JPMorgan’s top adviser of long-term investment, the investment portfolio mix as estimated by the S&P 500 Index and Bloomberg Barclays U.S. Aggregate Bond Index, yielded a yearly compounded rate of return of nearly 10% between 1983 and 2019.

The 60/40 portfolios returns would potentially drop to roughly 3.5% annually in the next ten years. However, investors could increase their returns to an amount a bit more than 4% if they choose a portfolio mix that includes 40% stocks, 20% bonds, and 40% securities with a combination of features of stocks and bonds.

They could, for instance, include the following in their portfolio mix: collateralized loan debts, commercial mortgage-backed securities, real estate investment trust funds, or utility stocks.

What Should The Investors Do?

Investors appear to have a similar view. For example, Conning from Hartford, Connecticut, an investment manager who manages 120 billion dollars within the last three months is closely investigating structured products like CLOs. This is because the price rise caused by the Fed’s emergency acquisition of assets hasn’t affected such assets. Also, the U.S. Bank Wealth Management boosted the funds allocated to investment-grade companies and municipal credit last month.

Investors are also beginning to look towards convertible bonds that provide a risk profile crosswise bonds and stocks. In the month of May, the U.S. exchange-traded funds that track such debt recorded over 300 million dollars. In June, the record went up to 427 million dollars and this is the largest ever recorded in a month for the past six months according to Bloomberg data.

Convertible bonds are gaining traction because they’re bonds and equally functions as equities. Thus, they work as bonds and can also be converted into stocks. They benefit if the prices of the stock are going up and also if the prices of bonds rally just like each of these classes of asset s has performed within the past three months.

Convertible bonds are currently very appealing in Europe, because of the CoCos system that saw financial institutions shoring up balance sheets and deleveraging since the last global financial crisis that occurred in 2008. These bonds have shown over 6% annual returns for the last five years till the end of June 2020. After resulting in a 9.4% annualized loss from January to June 2020, CoCos showed a return of 2 times the EU government bonds at the same time.

Conclusion

Despite the trouble that the 60/40 investment strategy is facing currently, many investors are still hoping that things might turn around for good. Jack McIntyre from Philadelphia, a 60 billion fund manager at Brandywine Global Investment doesn’t think that the strategy deserves the scrutiny it’s currently facing. He thinks 40 % allocation serves as a hedge for any type of investment asset.