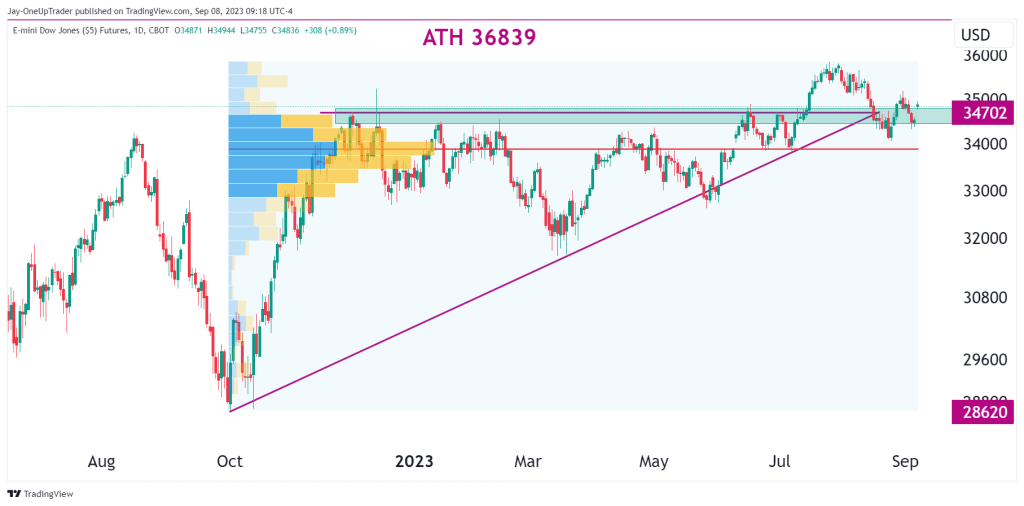

- YM has retraced back to the ascending trianlge.

- Price is currently trading within a high volume node, which is stalling price.

- Potential trade opportunity and stop placement for bulls.

Recap

The last time we looked at YM was almost a month ago when we watched price break out of an ascending triangle. It has been a rocky road for YM traders as the breakout did not last, and a retracement to the triangle has occurred. There may be opportunities arising as we speak, though, so read on to find out more.

Technical analysis

The Triangle formation remains intact as price is currently testing the horizontal line. A small gap has formed overnight, giving a possible great area for stops to be placed if traders are willing to go long. Before we look at the stop placement, let’s look at some technical indicators and the overall look of the chart.

As you can see in the image below, once we had the breakout, price stalled and has been moving in a sideways range for some time. I would want to see this push higher soon, or else we run the risk of the trianlge failing because of a lack of trading volume. The volume profile also shows us that price is currently stuck in a high-volume node, which explains why price has been reluctant to move with conviction recently. The good news is that above current levels, around $35000, we begin to move into low-volume node territory.

Looking back at trade opportunity, traders who are bullish on YM could place stops below the most recent swing low.