Introduction

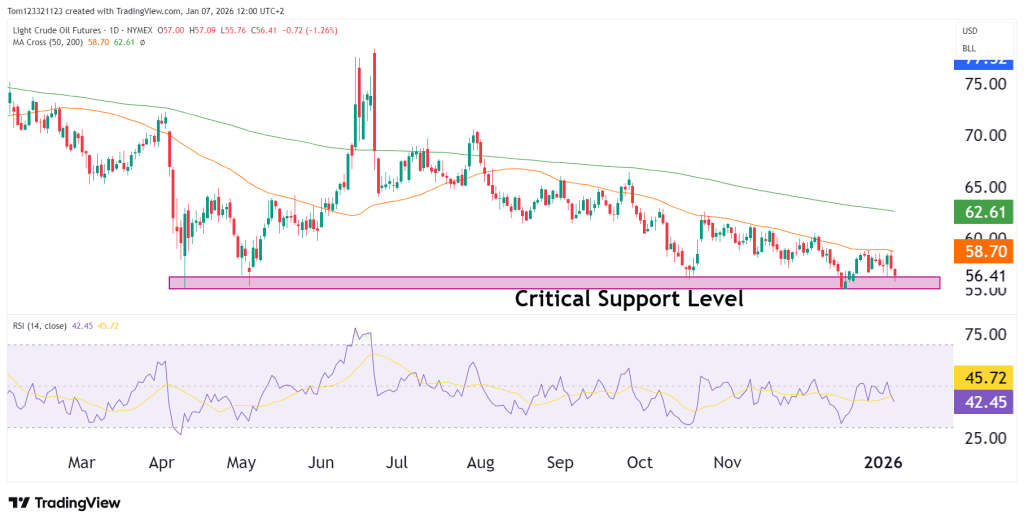

Crude oil (CL) continues to trade just above the critical support level between $55 and $56. The price has bounced out of this level five times since April as bulls step in to defend the price level. Overall, the trend is bearish in the long term, but the bulls holding above the support level means it is still consolidating between $55 and $62. The main fundamental element affecting CL is the uncertainty on the demand side, if that picks up, we could see a rise in the value of crude oil.

Market Structure & Trend

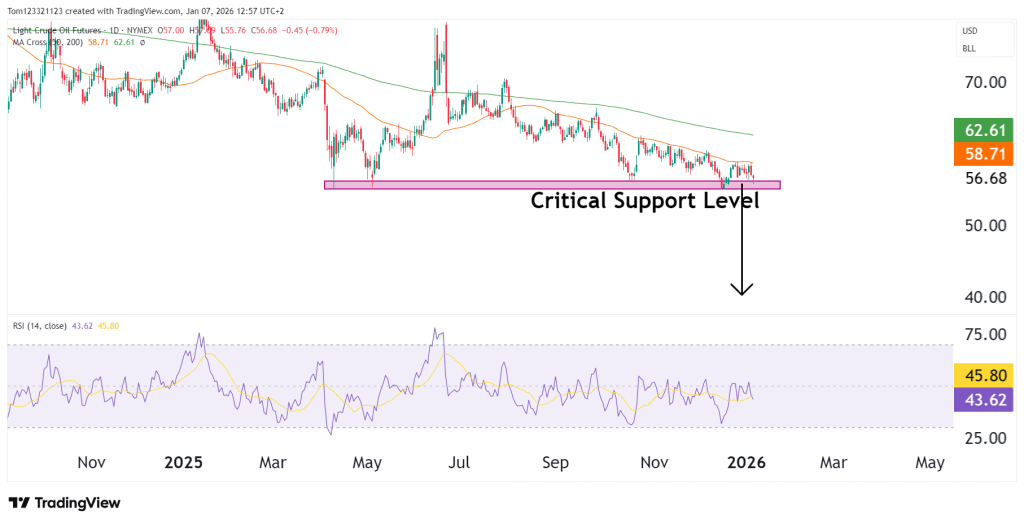

As mentioned above the trend is bearish to neutral depending on the time frame used. Long term, there are lower highs forming, and the support level at $55 is forming a big descending triangle, which, if broken to the downside, could lead to a big drop in the price.

CL is also trading below both the 50-day and 200-day moving averages, with the 50-day continuing to slope lower.

A drop below the support level could lead CL to $40 with high volatility. Each time the support level is tested, the weaker it gets until eventually it breaks, and the stop losses for the traders who are long get triggered. Bulls will need to defend the price if they want to maintain some hope of a rally.

Key Technical Levels

Resistance

- $58.50–$59.00: 50-day moving average and near-term supply.

- $62.50–$63.00: 200-day moving average and broader trend resistance.

Any sustained recovery would need price back above $59 to ease downside pressure.

Support

- $55.00–$55.50: Critical multi-month support zone

- $52.50–$53.00: Next downside target if support fails

- $50.00: Psychological and longer-term support level

Technical Scenarios Ahead

- Support hold & bounce:

Buyers defend $55 and CL rotates back toward the $58–$59 area. - Range continuation:

Price remains trapped between $55 and $59, reflecting continued indecision. - Support breakdown:

A clean break below $55 could accelerate selling toward $52–$50 or even $40 if volatility rises.

Estimated Probability Scenarios

| Scenario | Description | Estimated Probability |

|---|---|---|

| Support hold & bounce | Rebound from $55–$56 | 40% |

| Range consolidation | Chop between $55–$59 | 35% |

| Bearish continuation | Breakdown toward $52–$50 | 25% |

Fundamentals

Crude oil remains pressured by demand-side uncertainty, particularly concerns around global growth and softer consumption expectations. Traders are also monitoring U.S. inventory data, OPEC+ production policy, and geopolitical developments that could impact supply.

Upcoming EIA crude inventory reports, along with macro data influencing the U.S. dollar and growth outlook, may act as catalysts. A stronger dollar or rising inventories could add pressure, while supply disruptions or tighter balances may help stabilize prices near support.

This analysis is for educational and informational purposes only and does not constitute trading advice or a recommendation to buy or sell any futures contracts. Futures trading involves significant risk and may not be suitable for all investors. Always conduct your own research and consult with a licensed financial professional before making trading decisions.