- Consolidating pattern forming on 6C with slightly lower highs and slightly higher lows, providing trading opportunities to sell the top and buy the bottom range (0.75 to 0.73).

- Bullish interest increasing as indicated by higher lows, suggesting a potential breakout to the upside, supported by the monthly chart showing 6C at a significant multi-year low.

- Traders with a long-term time horizon can consider initiating positions now, anticipating a holding period of approximately one year.

Technical analysis

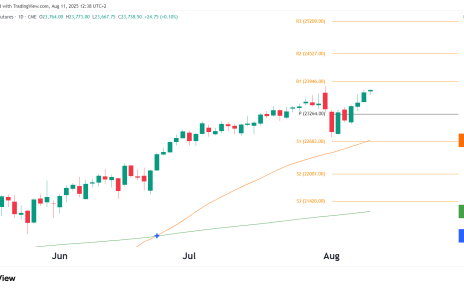

There is a consolidating pattern forming on 6C as the highs are slightly lower each time, and the lows are slightly higher each time. This range gives traders the possibility to make profits by selling the top and buying the bottom range. The top side range is around 0.75, and the bottom side range is around 0.73.

It looks like there is a slightly higher bullish interest at the moment, however, just by looking at the lows, which continue to be significantly higher each time compared to the top side of the pattern where the price just barely gets to the previous high before retracing.

Where to after the breakout

Even though the breakout is likely still a while away, if we zoom out and look at the monthly chart, 6C is at a significant multi-year low. Looking at the chart like that, we can suspect a break to the upside. This is backed up by the analysis above on the daily chart, with the lows significantly higher each time. Traders with a long-term time horizon could begin initiating positions now with the understanding that it would like to be a holding period of a year.