Goldman Sachs Group Inc. highlighted the recent mounting concern that inflation in the U.S. could make the US dollar lose its status as a haven.

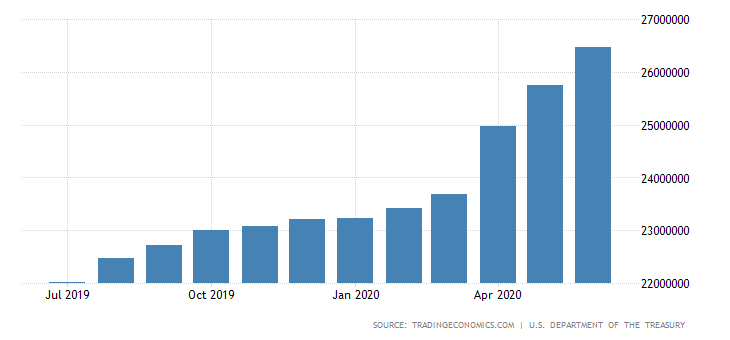

While Congress closes in on one more cycle of fiscal incentive to buttress the US economy that has been badly affected by the Covid-19 pandemic, and the Federal Reserve have also increased its balance sheet by roughly 2.8 trillion in 2020, Goldman analysts warned that the U.S. Monetary policy might trigger fears about currency devaluation. And if this happens, it would affect the ability of the dollar to act as a haven and affect its dominant role in the forex market.

Will the looming fears of Inflation affect the US dollar state as the reserve currency?

The financial analysts that are of the view that the USD might lose its state as a reserve currency are currently a minority group. The Goldman analysts that equally support that view aren’t also saying that it will surely happen. However, it shows the nervy situation currently in the market. Investors have concerns that printing more USD could lead to inflation going forward. Some of these investors are pulling their money out of the US Dollars and investing their money in gold.

Gold serves as a haven especially, anytime the financial market experiences the situation that is currently happening now. Such situations make governments of nations decide to devalue their fiat currencies and push their real interest rates to a very low rate, Goldman strategists reported. There are currently growing concerns about the U.S. dollar subsisting as a reserve currency.

The Goldman report clarifies that Wall Street’s previous hesitancy to give clear warning on inflation back when the epidemic started fading. The reputation of the US dollar has been badly affected by the gloomy predictions of high price gains that resulted from the fiscal and monetary incentives that occurred after the 2008 financial crisis. However, a lot of financial analysts have presently refused to make similar projections, particularly as the economy experiences a more profound recession.

The price of gold rises to a new record high

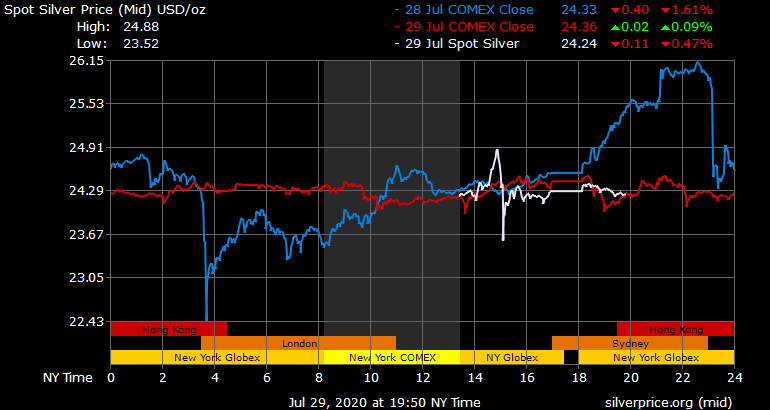

With the price of gold rising to record highs and with growing anticipations for inflation rising among bond investors day by day although, on a very small scale, the argument on the longstanding effects of incentive is heating up more and more. The 10-year success rate, the point at which the total cost and total revenue are equal between nominal and inflation-connected debt earnings, has moved up to roughly 1.51 percent, and that was an increase from the previous rate of 0.47 percent in March. That has resulted in actual profits, which eliminated out the influence of inflation, additionally fall below zero — to roughly -0.92 percent on related-maturity bonds.

The price of Gold which currently breaks rally climaxes is resulting in an increased worry about the state of the global economy. Goldman increased its annual gold forecast to 2300 dollars for one ounce from the earlier price of 2000 dollars. That’s a lot of increase when you compare it to the earlier value of roughly 1930 dollars. The bank envisages that the U.S. real interest rates will continue to move lower and this will additionally increase the prices of gold.

In the meantime, the Bloomberg Dollar Spot Index is experiencing the worst July economy for the past ten years. The fall resulted from increased calls for the dollar’s decease after the EU’s rescue package deal which serves as a game-changer boosted the Euro price and will result in mutually issued debt.

Anticipations of the potential effect of connecting prices to the guidance on the policy rate

Another factor that is increasing the pressure on the potential inflation anticipations is projections that it won’t be long before the Fed will connect prices to the guidance on the policy rate. If this occurs, it would offer at least some momentary space for inflation to rise beyond the 2 % target of the central bank. “The resultant long-drawn-out balance sheets and huge money creation shoots up the fear about possible devaluation of the dollar.

This results in an “a greater possibility that at come a time in the future, when the state of the economy gets better, Central banks and governments will have incentives that will make inflation to rise to minimize the accrued debt liability,” says Goldman analysts.

Breakdown Of Returns

Among the 18% returns projection for gold in the coming year, Goldman appraisals show that 9% will be the result of five-year real rates minus 2%, and the remaining part of the “15% rise in the EM dollar GDP.

The US increasing Debt Pile

For Goldman, the rising level of debt in the U.S. — which currently is higher than 80% of the country’s gross domestic product — and in a different place, increases the risk that central banks and governments may encourage inflationary measures. Investors are anxiously waiting to hear more about the Fed’s outlook on inflation with its newest policy decision on Wednesday, the 29th of July 2020.