- Chinese manufacturing activity declined more than anticipated in May.

- The US dollar gained support from lower European inflation.

- In April, there was an unexpected rise in US job openings.

Oil prices fell on Wednesday due to a stronger US dollar and disappointing data from China, raising concerns about demand. Chinese manufacturing activity declined more than anticipated in May. The manufacturing purchasing managers’ index dropped to 48.8 from April’s 49.2, falling short of the expected 49.4 and resulting in a sharp decline in oil prices.

The US dollar gained support from lower European inflation and bipartisan US debt ceiling bill progress. This bill was debated in the House of Representatives, where it passed. The Senate’s discussion could extend into the weekend, with a deadline of June 5 approaching.

The strengthening of the dollar makes oil costlier for buyers using other currencies.

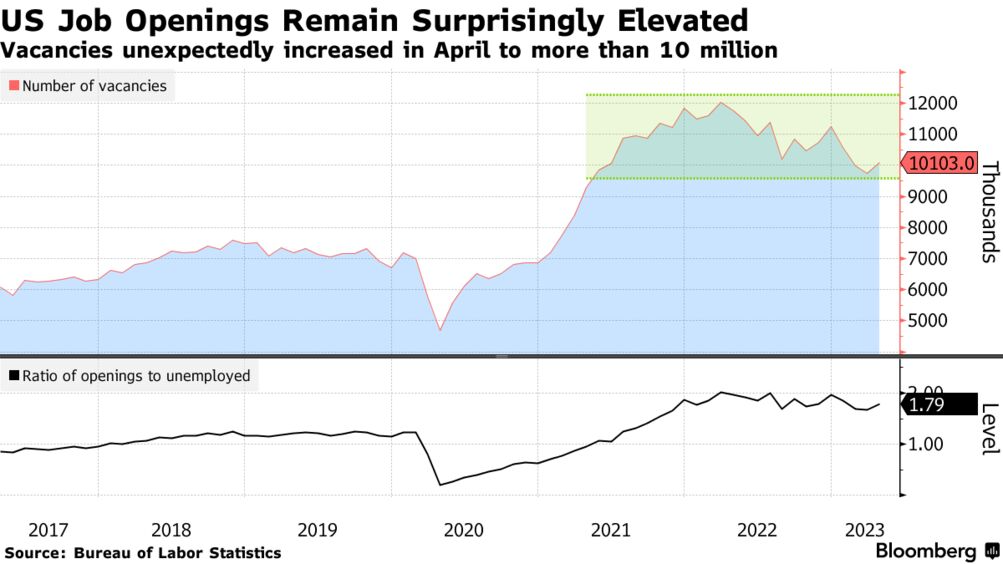

In April, there was an unexpected rise in US job openings, and the data for the previous month was revised upward, indicating ongoing strength in the labor market. This strength could prompt the Federal Reserve to raise interest rates in June.

Furthermore, a Job Openings and Labor Turnover Survey report released on Wednesday revealed a significant decline in layoffs last month.

According to Bob Yawger, director of energy futures at Mizuho, market sentiment is influenced by a combination of factors. These include weak Chinese data, the debt ceiling situation, two years of stagnant spending, and the likelihood of another interest rate hike next month.

Additionally, traders are closely monitoring the upcoming meeting of OPEC+ on June 4. OPEC, Russia, and their allied countries have been giving mixed signals regarding further production cuts, causing volatility in oil prices. However, HSBC, Goldman Sachs, and analysts do not anticipate additional cuts being announced at this meeting.

HSBC predicts that stronger oil demand from China and the West starting in the summer will result in a supply deficit during the year’s second half.

In March, crude oil production in the US reached 12.696 million barrels per day, the highest level since March 2020, when the onset of the coronavirus pandemic severely impacted the global energy demand. This is according to data from the Energy Information Administration.

Furthermore, a preliminary Reuters poll on Tuesday indicated that US crude oil and gasoline inventories likely decreased last week, while distillate inventories likely increased.