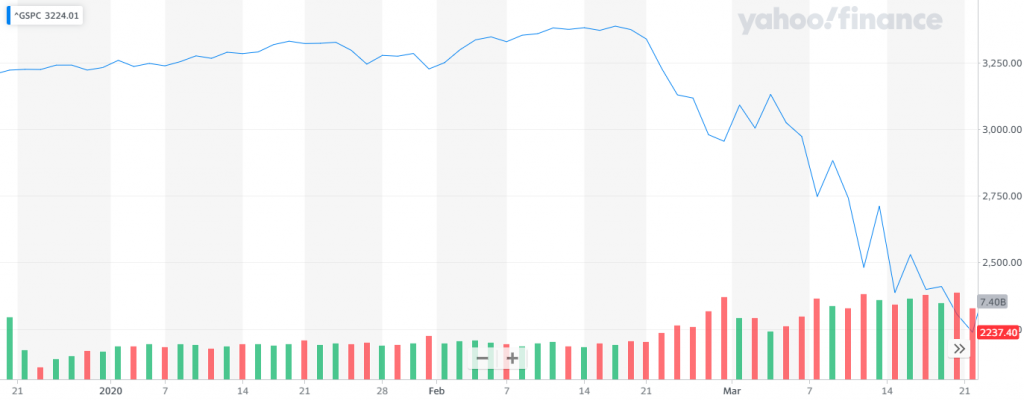

The history of the stock market is filled with lots of drama. This includes the market crash in 1929, the fall in share price by 20% in one day on Black Monday in 1987 as well as 1999’s dotcom craze. Therefore, after these occurrences, then nothing should be much of a surprise, right? Well, that has not been the case since, over the last eight weeks, the remarkable has happened. This is due to the heightened sale of shares, thereby resulting in a frantic rally in America. Because of this, the value of the S&P index fell by a third between February 19th and March 23rd, 2020.

However, there has been a quick turnaround, which has led to the recovery of over half the value. All this was thanks to the news that the Federal Reserve would start purchasing corporate bonds, thereby assisting huge corporations to pay back their debts. This immediately changed the mindset of investors from panic to optimism.

The skeptical point of view

Nevertheless, you still need to be skeptical of this somewhat hopeful message from Wall Street. The reason for this is that other markets around the globe, for instance, Britain and continental Europe have a sluggish growth of share prices. Furthermore, this differs significantly from life on Main Street. Although America is slowly easing its lockdown, the loss of jobs has been so severe that the employment levels rose from 4% to around 16%. This is the greatest rate since the start of records in 1948. Whereas the huge firms are flourishing thanks to the Fed’s assistance, small businesses have not been as lucky to receive money from Uncle Sam.

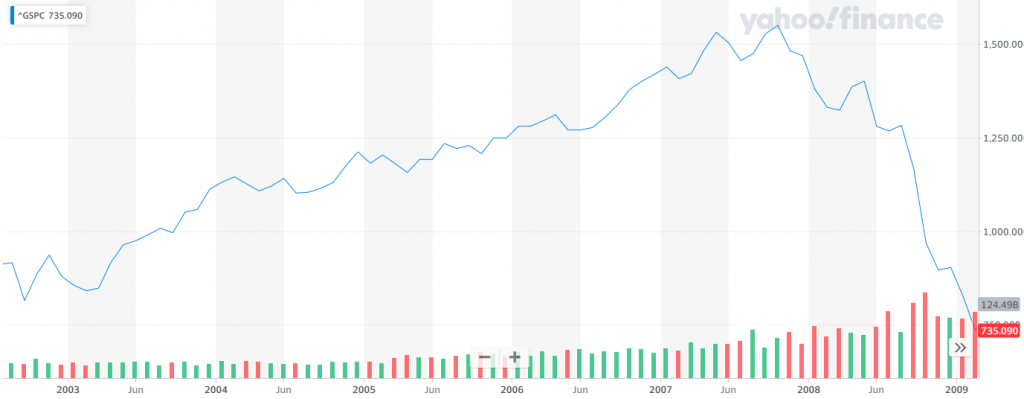

A quick look into the past

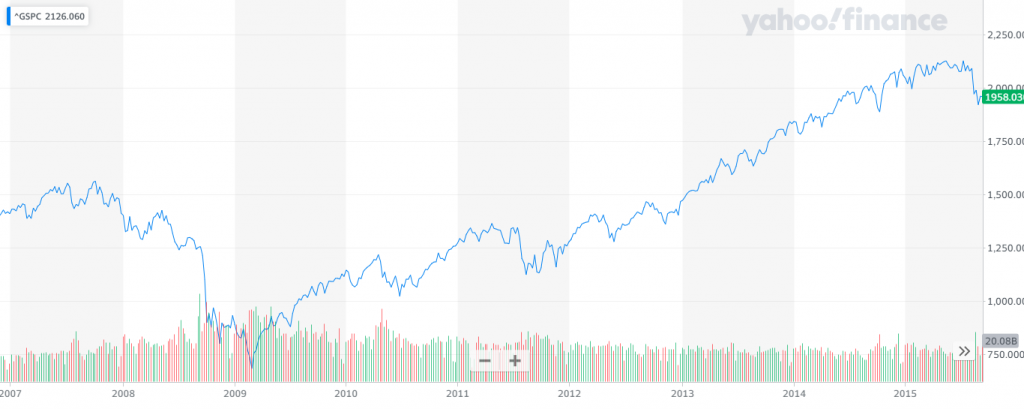

The current crisis has started opening the wounds of the 2007 to 2009 financial crisis.

According to Joe Biden, a Democratic presidential candidate, big corporations are having their assets bailed for the second time now. Due to this, conflict over this pandemic’s fiscal burden has just started, and by assessing the current path, there is a possible backlash with massive firms.

Stock market overview

Let’s begin by analyzing the stock market events. A lot of improvement has taken place due to the drastic measures put in place, unlike other central banks in purchasing assets at an unexpected scale. The Fed has pledged to buy a lot more corporate debt, such as high-yield “junk” bonds. Subsequently, the new issuance of corporate bonds that was frozen in February has experienced an incredible reopening. This has led to firms issuing bonds worth $569 billion in the last six weeks, with this double the average level. The same has happened to beached cruise-line companies that are now in a position to raise cash, despite the price being quite high. Therefore, this has led to the forecast of a series of bankruptcies at huge corporations, causing the central bank to backstop the cash flow of America Inc. This has had a positive impact on the stock market, which has started to rise.

However, the Fed cannot do much here since a run of the corporate-bond market might exacerbate the recession impact, with investors cheering this on by buying shares. This is happening because they do not have anywhere to store their money, especially since, in America, government bond yields are not very positive. They hurt a big part of Europe and Japan, and you might lose your cash if you hold them until maturity. If inflation continues to increase, this would be devastating, and this consequently makes sticks an attractive option. As of late March, stock prices had fallen by a considerable amount to appear appealing to the risk-takers. These individuals reasoned that a lot of the stock market value is linked to the profits, which will be generated once the COVID-19 slump is done, giving room to recovery.

Whereas this recent increase in the price of shares is uneven, the stock market was still lopsided way before the spread of the pandemic. In continental Europe and Britain, bourses are filled with lots of distressed industries such as energy, banking, and car-making experiencing noticeably reduced growth, thereby renewing concerns over one currency. Nonetheless, investors in America have decided to place their hopes with a small group of tech companies. These include Microsoft, Apple, Amazon, Facebook, and Alphabet, which account for a fifth of the S&P 500 index. There is, however, little excitement since only a handful of firms are considered as all-weather survivors.

This at one level is logical, with asset managers now putting their money to work the best they can. Nevertheless, all is not well if you assess the rate at which stock prices have been moving as well as where they are at the moment, with share prices in America greater than where they were back in August.

Three market threats on the way to recovery

Yes that the market, as well as the wider economy, might go back to normal operations. But there is a myriad of threats hovering around this prospect, but three are noticeable.

1. Second coronavirus wave

The first possible risk is that of an aftershock, as there is still a likelihood of a second wave of illnesses. Moreover, the impact of a steep recession is also one that will have to be experienced, with the second quarter of the American GDP anticipated to fall by around 10% in comparison to last year. Most of the individual bosses believe that taking brutal cost-cutting measures will help safeguard their margins and pay back the debts amassed through the layoff. Nonetheless, such actions by the company would further reduce demand, and the potential outcome is 90% of the economy operating much lower its average levels.

2. Fraud Management Problems

The second potential threat is a fraud. The expansion period prior to the COVID-19 crash was the longest on record, and such periods of prolonged booms usually promote devious behaviors. Thus, after years of financial engineering and cheap money, accounting mischiefs may now get exposed. In the last couple of weeks, noticeable scandals have already been seen in Asia. The two companies involved are Hin Leong, an energy trader in Singapore which has not been revealing its tremendous losses and Luckin Coffee, a Starbucks imitator. A corporate collapse or a huge fraud scandal in America would destabilize the markets, the same way the fall of Enron in 2001 made investors nervous, and Lehman Brothers caused a down in 2008.

3. Political Risk

Another possible danger that is being ignored is a potential political backlash. This COVID-19 slump will have a devastating impact on smaller businesses and leave the huge corporations that survive this is a better position. Because of this, there will be a rise in certain industries that were causing an issue even before this pandemic. During periods of crisis, sacrifice is paramount, and this leaves behind a huge bill. The demand for payback will keep growing louder if massive companies decide to hog more than its share of subsidies it can avail. It is now easy to envision a drastic reversal of a stable reduction in the legal federal corporate tax rate, which is at 21% from more than 30% after the implementation of President Donald Trump’s tax reforms or extra taxes from industries that have just been bailed out. Some of the Democrats are looking to prevent companies from paying back their owners as well as minimize mergers.

Now what..?

Presently, the feeling among equity investors is that they have the backing of the Fed. Nonetheless, the market’s atmosphere changes abruptly, and the last few months are proof of this. This means that a one-month bear market is not enough time to absorb all the negative impact the COVID-19 pandemic has had on the stock market and the uncertainty it has caused. With this in mind, it is best to be braced for a couple of surprising moves from the stock market.