Introduction Crude oil futures have rebounded after testing support, but the long-term downtrend resistance remains intact. As of today, NYMEX WTI crude oil (CL) is trading at $73.00, up 0.94%, as buyers attempt to push prices higher after a recent rejection near $75.30. However, the descending trendline that has capped rallies since mid-2023 remains a Read More…

Month: February 2025

Currency Futures Under Pressure Amid Tariff Fears, Fed Rate Speculation

Currency futures eased on Friday amid concerns of trade wars after Trump announced more tariffs. However, some rebounded on Monday as market participants geared up for crucial US consumer inflation figures this week that will shape the outlook for Fed rate cuts. These two factors will continue shaping market movements this year. Trading survey (Source: Read More…

Gold continues its rallies after bullish breakout

Introduction Gold futures have extended their upward momentum following last week’s gap-up breakout. The metal’s price action has confirmed a symmetrical triangle breakout, with prices surging past the ATH. Technical outlook Gap-Up & triangle breakout confirm strength Gold’s breakout from the symmetrical triangle pattern last week triggered a strong continuation rally. The initial breakout was Read More…

Interest Futures Stay Elevated After Trump’s Tariff Pause

Interest futures held near recent peaks as Treasury yields collapsed after Trump paused tariffs on Canada and Mexico. The pause also came as market participants eagerly awaited the US nonfarm payrolls report for insight into the Fed’s policy path. US 10-year Treasury yields (Source: Bloomberg) Interest futures have risen since Tuesday when Trump paused expected Read More…

Japanese Yen futures attempt a rebound amid Dollar strength

Introduction Japanese Yen Futures (6J) are trading at 0.006584, up slightly in recent sessions after bouncing from multi-month lows. The break above the 50-day SMA (0.0064998) and a test of the 200-day SMA (0.0065950) call on bulls to continue the buying pressure to push prices back to 0.00718. However, the broader trend remains bearish as Read More…

Crude Oil Prices Tumble on Weak Demand Signals

Oil prices collapsed on Wednesday after data revealed an unexpected surge in US crude oil inventories, pointing to weak demand. At the same time, concerns about a trade war between China and the US put downward pressure on prices. Data on Wednesday revealed that US crude inventories rose by 8.664 million barrels last week. Meanwhile, Read More…

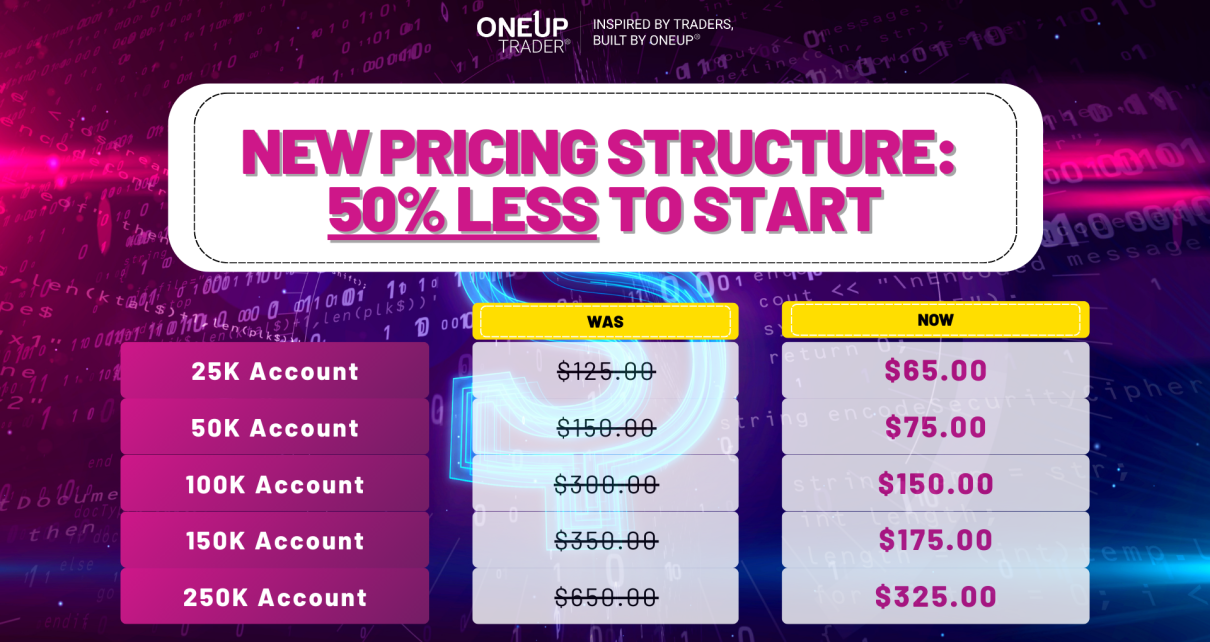

New Pricing: Pay 50% Less to Start Your Evaluation

Introduction Are you ready to prove your skills but hesitant about the upfront cost? We’ve just made it easier than ever to start your funded trading journey. With our new pricing model, you can now start your evaluation by paying only 50% of the evaluation fee upfront—and the other 50% only if you pass! This Read More…

Gold Shines as Trade War Fears Drive Safe-Haven Demand

Gold prices extended gains on Wednesday as investors scrambled for safety in the yellow metal amid fears of a trade war between the US and China. Meanwhile, data in the previous session revealed some weakness in the US labor market, putting pressure on the Fed to cut rates. However, market participants are more focused on Read More…

Nasdaq (NQ) consolidate inside triangle, awaiting breakout

Introduction Nasdaq 100 E-mini futures (NQ) are currently trading at 21,464, down 0.95% for the session, as price action consolidates within a symmetrical triangle formation. With the 50-day SMA (21,483.66) acting as short-term support and the 200-day SMA (20,040.68) providing long-term support, Nasdaq futures are coiling within a tightening range. Lets see what the technicals Read More…

Crude Oil (CL) reverses lower after trendline rejection

Introduction In our January 24, 2025 analysis, we highlighted crude oil’s rally into resistance at the 200-day SMA (74.54) and the descending trendline. We noted that failure to break above these levels would likely result in a pullback, with support levels around 71.97 (50-day SMA) and the broader $67.00 – $68.50 support zone coming into Read More…